Ever wondered what is algo trading and how traders use algorithms to execute trades automatically? In this article, you’ll learn exactly what algo trading is, how algo trading works, and practical steps on how to start algo trading.

What is Algo Trading?

Algo trading, or algorithmic trading, involves using computer programs to execute trades automatically based on predefined rules and strategies. These algorithms analyze market data, identify opportunities, and execute trades at lightning speed. It removes human emotions, allowing for consistent and disciplined trading decisions.

How Algo Trading Works

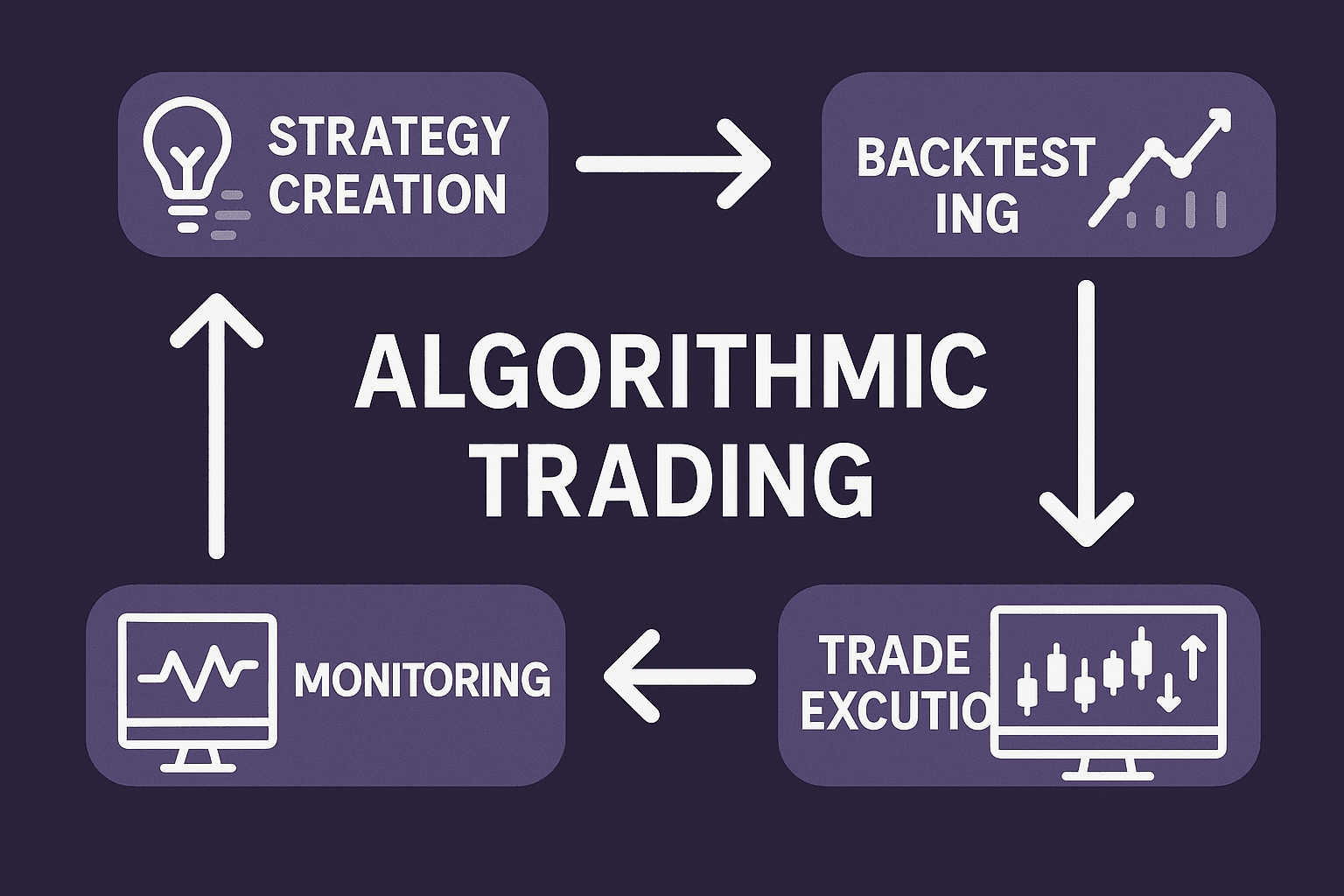

Algo trading uses specific instructions known as algorithms. These instructions consider factors like price, timing, volume, and market conditions. Here’s how it typically works:

- Strategy Formulation: You first define a clear trading strategy. For instance, you might want to buy when a stock reaches a specific price or sell when indicators signal a downturn.

- Backtesting: Before deploying any strategy, traders use historical data to test how effective their algorithm would have been. This helps refine the strategy and reduce risks.

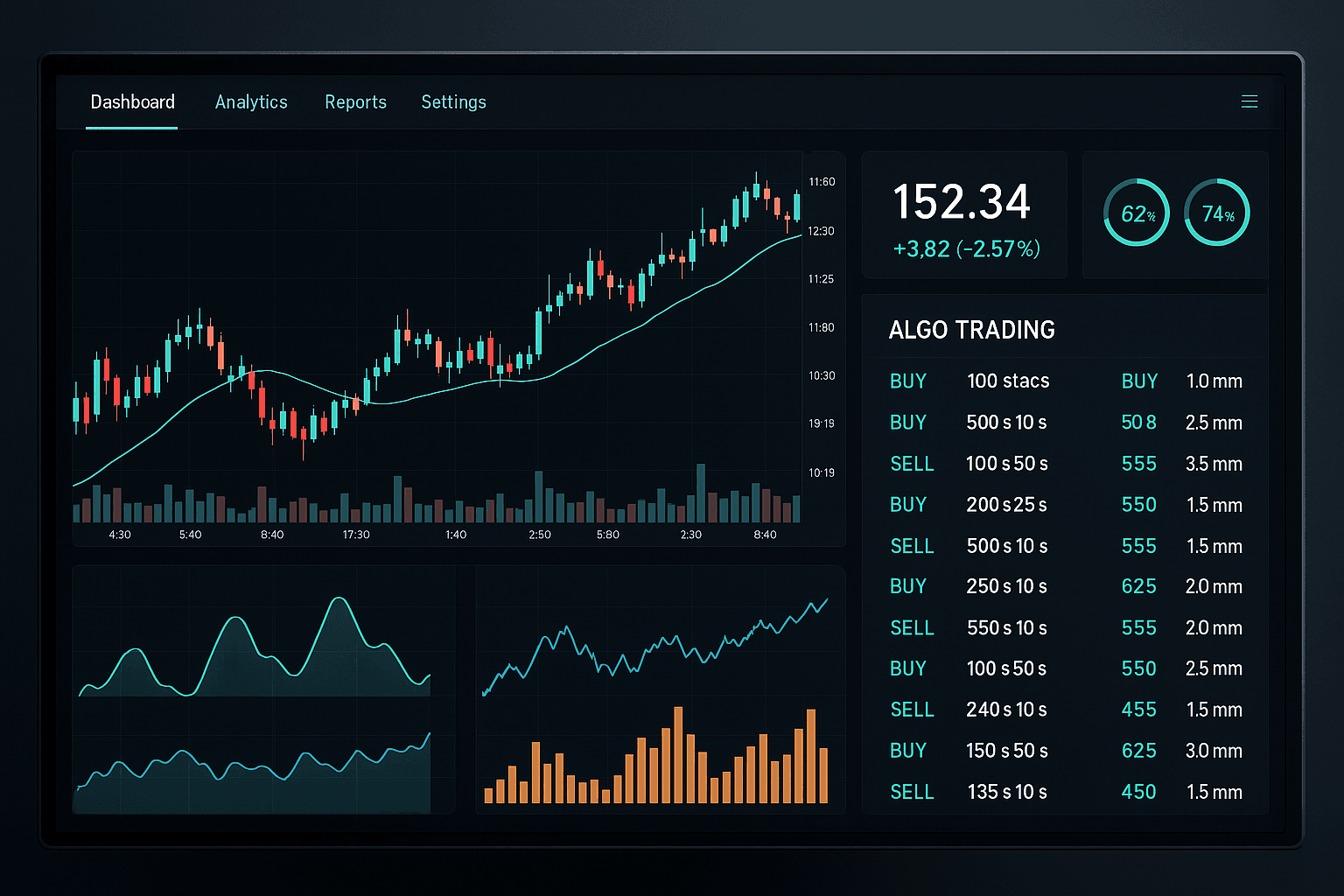

- Execution: Once validated, algorithms automatically execute trades in real-time, ensuring high accuracy and speed.

- Continuous Monitoring: Traders monitor algorithms closely to tweak or stop them as market conditions change.

Why Use Algo Trading?

Algo trading offers several compelling advantages:

- Speed and Accuracy: Trades execute instantly, minimizing delays common with manual trading.

- Eliminates Emotions: Algorithms eliminate emotional trading decisions, reducing errors caused by panic or excitement.

- Efficiency: It enables trading large volumes quickly and effectively.

- Consistency: Provides disciplined execution, sticking strictly to your trading strategy.

How to Start Algo Trading

Getting started with algo trading might seem daunting initially, but it doesn’t have to be complicated:

Step 1: Understand Trading Basics

Before diving into algo trading, ensure you understand fundamental trading concepts, such as market orders, limit orders, and trading indicators.

Step 2: Choose a Trading Platform

Select a reliable trading platform supporting algo trading, such as MetaTrader, Interactive Brokers, or Zerodha. Look for platforms offering easy integration and comprehensive support.

Step 3: Learn Programming or Use Existing Bots

You can either learn programming languages like Python or use existing trading bots. Python is highly recommended due to its simplicity and extensive libraries.

Step 4: Define and Backtest Your Strategy

Clearly define your trading criteria and strategy. Utilize backtesting tools available on your chosen platform to assess your strategy against historical market data.

Step 5: Deploy Your Algo

Once satisfied with the backtest results, deploy your algorithm. Start small to observe its real-time performance and gradually increase your trade volume.

How to Use Algo Trading Effectively

Here are some practical tips for effectively using algo trading:

- Set Clear Objectives: Always define precise goals for your algo strategy, such as profit targets and risk limits.

- Constantly Monitor Performance: Regularly review your algo’s performance to adjust settings or strategies as market conditions evolve.

- Risk Management: Always incorporate risk management techniques, like stop-loss orders, to protect your investments.

FAQs about Algo Trading

Q1. Is algo trading profitable?

Algo trading can be profitable if strategies are well-developed, thoroughly backtested, and regularly monitored and adjusted based on market conditions.

Q2. What programming language is best for algo trading?

Python is widely considered the best language for algo trading due to its ease of use, powerful libraries, and strong community support.

Q3. How much money do you need to start algo trading?

The required capital varies, but you can begin algo trading with as little as a few hundred dollars. However, having more capital typically allows for better diversification and risk management.

Q4. Can beginners use algo trading?

Yes, beginners can use algo trading, especially with user-friendly platforms and pre-built bots. However, beginners should invest time in learning trading basics and risk management strategies.

Conclusion

Understanding what is algo trading provides you with powerful tools to trade efficiently and systematically. By following the steps outlined above, you can effectively start and use algo trading to enhance your trading performance and achieve consistent results.