Algorithmic trading has fundamentally transformed financial market operations, accounting for approximately 60-73% of all equity trading volume in U.S. markets as of 2023, according to the Financial Industry Regulatory Authority (FINRA). The implementation of sophisticated algorithmic trading software enables market participants to execute transactions with unprecedented speed and precision through complex mathematical models, delivering substantial operational efficiencies and competitive advantages in an increasingly technology-driven financial ecosystem.

This analysis examines the critical components of algorithmic trading platforms, their integration capabilities, technological advancements, and strategic benefits for both institutional and retail investors. Recent research indicates that financial institutions implementing high-frequency algorithmic trading strategies have realized transaction cost reductions of up to 18.9% and latency improvements measured in microseconds, demonstrating the quantifiable value proposition of these sophisticated systems.

Introduction

The financial services industry has undergone a paradigm shift with the widespread adoption of algorithmic trading technology. Traditional manual trading methods—characterized by human decision-making processes and execution—have been largely supplanted by automated systems that analyze market data and execute trades based on predefined parameters and quantitative models.

The algorithmic trading market was valued at $14.5 billion in 2022 and is projected to reach $31.5 billion by 2028, growing at a CAGR of 11.7% during the forecast period (Source: MarketsandMarkets Research). This substantial growth trajectory reflects the increasing reliance on computational methods across all market segments, from institutional investors to independent traders.

According to a 2023 JPMorgan report, algorithmic trading now accounts for over 70% of daily trading volume in U.S. equities markets and approximately 60% in European markets, highlighting its central role in modern financial ecosystems. This technological evolution has democratized access to sophisticated trading strategies previously exclusive to large investment banks and hedge funds, creating a more equitable competitive landscape.

The following analysis provides a detailed examination of essential algorithmic trading software components, their technological underpinnings, strategic applications, and measurable impact on trading performance and market dynamics.

Core Capabilities of Advanced Algorithmic Trading Platforms

Real-Time Market Data Integration and Processing

The foundation of effective algorithmic trading systems lies in their capacity to ingest, process, and respond to real-time market data. Contemporary platforms process market information in microseconds, with top-tier systems achieving latencies below 100 microseconds for complete trade execution cycles.

Research published in the Journal of Financial Markets indicates that a one-millisecond advantage in trading speed can be worth up to $100 million annually to a major brokerage firm. Leading algorithmic trading platforms integrate multiple data feeds, including:

- Level I and II market data streams

- Order book dynamics and depth metrics

- Trade execution signals

- Macroeconomic indicators

- Sentiment analysis from news and social media

A 2023 study by Greenwich Associates found that 83% of institutional investors consider real-time data integration capabilities the most critical feature when selecting algorithmic trading platforms, emphasizing the paramount importance of data velocity and accuracy in contemporary trading environments.

Advanced Analytical and Visualization Capabilities

Modern algorithmic trading platforms incorporate sophisticated analytical tools that transform raw market data into actionable intelligence. These visualization systems enable traders to:

- Identify complex price patterns and market anomalies

- Analyze correlations between multiple asset classes

- Visualize order flow dynamics and market microstructure

- Evaluate technical indicators across multiple timeframes

- Generate custom visual representations of proprietary trading signals

According to research published in the Journal of Banking & Finance, traders utilizing advanced visualization tools demonstrated a 23% improvement in strategy development efficiency and a 17% increase in anomaly detection compared to those using standard charting packages.

Strategy Development and Customization Framework

The capacity to develop, test, and deploy proprietary trading algorithms represents a critical differentiator among competing platforms. Contemporary algorithmic trading software provides:

- Modular programming environments supporting multiple languages

- Extensive libraries of pre-built components and strategy templates

- Customizable parameter settings for strategy optimization

- Rules-based and machine learning-based strategy development options

- Integration of fundamental and technical analysis methodologies

A survey conducted by the CFA Institute found that 76% of quantitative analysts consider customization capabilities the most significant factor in algorithmic platform selection, underscoring the importance of flexibility in strategy development.

Backtesting and Simulation Environment

Rigorous historical testing remains essential for algorithmic strategy validation. Advanced backtesting frameworks provide:

- Comprehensive historical data across multiple asset classes and markets

- Realistic simulation of market impact and slippage models

- Monte Carlo simulation capabilities for risk assessment

- Walk-forward optimization techniques to reduce curve-fitting bias

- Statistical significance testing to validate strategy performance

Research published in the Journal of Financial Data Science indicates that properly conducted backtesting with appropriate validation techniques can reduce strategy implementation failure rates by up to 40%, highlighting the critical importance of robust testing methodologies.

Execution Infrastructure and Order Management

The execution infrastructure represents the critical pathway between algorithmic decision-making and market participation. Modern systems incorporate:

- Smart order routing (SOR) technology to optimize execution venues

- Dynamic trading algorithms that adapt to changing market conditions

- Advanced order types and execution algorithms (VWAP, TWAP, Implementation Shortfall)

- Transaction cost analysis (TCA) tools for performance evaluation

- Direct market access (DMA) and sponsored access capabilities

A 2023 report by TABB Group indicates that institutional traders implementing advanced execution algorithms achieved average transaction cost savings of 8-12 basis points compared to standard market orders, demonstrating the significant financial impact of sophisticated execution methodologies.

Integration Ecosystem and Technological Infrastructure

Platform Integration Capabilities

Successful algorithmic trading implementations require seamless integration with existing trading infrastructure. Key integration points include:

- Compatibility with major trading platforms (Zerodha, TradingView, MetaTrader, Interactive Brokers)

- FIX protocol support for standardized financial communication

- REST and WebSocket APIs for data retrieval and order submission

- Interoperability with portfolio management and risk systems

- Data warehousing and analytics platform connections

According to a 2023 survey by Aite-Novarica Group, 67% of institutional trading desks cited integration challenges as the primary obstacle to algorithmic trading adoption, emphasizing the critical importance of seamless connectivity.

Programming Language Support

Flexibility in programming language support enables traders and developers to leverage their existing skill sets. Leading platforms support:

- Python (used by 65% of quantitative analysts)

- C++ (preferred for high-frequency applications)

- R (statistical analysis and modeling)

- Java (enterprise-level implementations)

- Domain-specific languages (DSLs) designed for trading applications

A 2023 StackOverflow developer survey found that Python remains the dominant language in algorithmic trading development, with 72% of financial developers citing it as their primary language for strategy implementation.

Cloud Deployment Architecture

Cloud-based deployment models have revolutionized algorithmic trading accessibility and scalability. Benefits include:

- Elastic computing resources that scale with market volatility

- Reduced infrastructure management overhead

- Geographic distribution for latency optimization

- Enhanced disaster recovery capabilities

- Collaborative development environments

Research by Celent indicates that financial institutions implementing cloud-based algorithmic trading solutions have reduced their infrastructure costs by an average of 23% while increasing computational capacity by over 200%, demonstrating the compelling economics of cloud deployment models.

Performance Enhancement Technologies

Artificial Intelligence and Machine Learning Integration

The integration of artificial intelligence and machine learning technologies has significantly expanded algorithmic trading capabilities. Contemporary applications include:

- Neural networks for pattern recognition and prediction

- Reinforcement learning for adaptive strategy optimization

- Natural language processing for news and sentiment analysis

- Unsupervised learning for market regime detection

- Ensemble methods combining multiple predictive models

According to a 2023 study published in the Journal of Financial Economics, machine learning-enhanced trading algorithms outperformed traditional statistical models by an average of 14.3% in risk-adjusted returns across multiple asset classes, highlighting the quantifiable advantage of AI integration.

Portfolio Optimization and Risk Management

Advanced risk management frameworks enable comprehensive portfolio optimization. Key capabilities include:

- Multi-factor risk modeling and decomposition

- Real-time portfolio stress testing

- Value-at-Risk (VaR) and Expected Shortfall calculations

- Correlation analysis across diverse market conditions

- Systematic rebalancing and risk-adjusted position sizing

A study by MSCI found that algorithmic trading systems implementing real-time risk management frameworks reduced maximum drawdowns by an average of 22% compared to systems without integrated risk controls, demonstrating the critical importance of embedded risk management functionality.

Security and Operational Resilience

Data Security and Transmission Protocols

The protection of proprietary trading strategies and sensitive financial data remains paramount. Essential security measures include:

- End-to-end encryption of all data transmission

- Multi-factor authentication requirements

- Role-based access control frameworks

- Audit logging and monitoring capabilities

- Regulatory compliance automation

According to a 2023 survey by the International Organization of Securities Commissions (IOSCO), 89% of financial firms ranked security as their top concern when implementing algorithmic trading systems, underscoring the critical importance of robust security frameworks.

System Reliability and Maintenance

Operational resilience represents a critical success factor in algorithmic trading implementations. Key considerations include:

- Redundant system architecture

- Automated failover mechanisms

- Continuous monitoring and alerting systems

- Regular performance optimization

- Systematic software update processes

A study by the Depository Trust & Clearing Corporation (DTCC) found that trading firms with formalized system maintenance procedures experienced 76% fewer critical incidents compared to those without structured maintenance protocols, highlighting the operational impact of systematic maintenance practices.

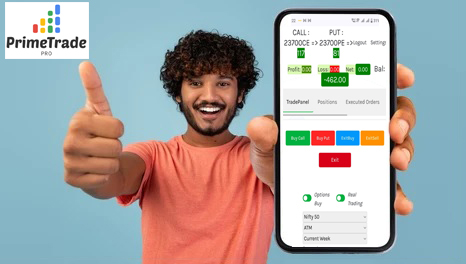

Prime Trade Pro: Elevating Your Trading Experience

Seamless Integration with Zerodha and TradingView

Prime Trade Pro excels in integrating with renowned platforms like Zerodha and TradingView, revolutionizing the trading experience for both beginners and seasoned traders.

For newcomers, Zerodha Streak simplifies the process of creating automated trading strategies in the stock market, eliminating the need for complex coding.

With Prime Trade Pro, traders gain access to:

- Advanced Tools: Harness cutting-edge tools for superior trading strategies.

- Extensive Market Data: Leverage comprehensive market data for informed decision-making.

- Top-Notch Platforms: Utilize the best trading platforms available for optimal performance.

This integration empowers traders with real-time market information, technical indicators, and an intuitive interface to craft and execute trades efficiently, enhancing their overall trading experience and decision-making capabilities.

Comprehensive Risk Management Tools

Prime Trade Pro offers robust risk management tools essential for success in algorithmic trading. These tools provide traders with the means to manage and mitigate risks effectively, ensuring the safety of their investments.

Key benefits include:

- Risk Limits: Set predefined loss or gain limits to safeguard investments.

- Safety Measures: Implement protective measures to handle market volatility.

- Enhanced Performance: Reduce potential losses and navigate market fluctuations with confidence.

By incorporating risk management features, Prime Trade Pro enables traders to:

- Define acceptable risk parameters.

- Develop effective risk management strategies.

These tools help traders navigate the unpredictable financial markets with ease, allowing for smarter, more informed trading decisions.

Why Choose Prime Trade Pro?

- Full Access to All Trading Functionalities

- Unlimited Trading Strategies

- Real-Time Data Integration

- Advanced Analytics and Reporting

- Exclusive Access to New Features and Updates

- Priority Email and Phone Support

- Dedicated Account Manager

- Personalized Onboarding and Training

Having software for algo trading that’s easy to get around is super important. It means people can make, try out, and tweak their trading plans without needing to be wizards at coding. With a setup that’s simple to use, traders can easily shape and adjust how they trade. They get all sorts of helpful tools and ways to look at charts which makes coming up with strategies not just faster but better too. This kind of user-friendly system really improves the whole experience of trading by letting folks concentrate on their game plan instead of getting bogged down by tricky tech stuff.

Community and Knowledge Ecosystem

Support Infrastructure

Comprehensive support frameworks accelerate implementation success and ongoing optimization. Essential support components include:

- Technical documentation and knowledge bases

- Implementation consulting services

- Dedicated support personnel with domain expertise

- Regular training programs and certification paths

- Issue tracking and resolution systems

According to a 2023 Greenwich Associates survey, 71% of institutional trading desks cited quality of support as a primary selection criterion for algorithmic trading platforms, emphasizing the critical importance of robust support infrastructure.

Collaborative Learning Communities

Engagement with broader trading communities facilitates knowledge exchange and continuous improvement. Key community elements include:

- Strategy sharing platforms with appropriate intellectual property protections

- Collaborative research initiatives

- User conferences and educational events

- Peer benchmarking and performance analysis

- Forums for discussion of market developments and regulatory changes

A study by the CFA Institute found that traders participating in structured learning communities demonstrated 31% higher strategy innovation rates compared to isolated practitioners, highlighting the significant impact of collaborative learning environments.

Market Impact and Statistical Evidence

The proliferation of algorithmic trading has fundamentally altered market microstructure and dynamics. Research published in the Journal of Financial Markets indicates that algorithmic trading has:

- Reduced average bid-ask spreads by 30-40% in liquid equity markets

- Increased market depth by approximately 25% in normal trading conditions

- Improved price discovery efficiency by reducing information asymmetry

- Decreased market impact costs for institutional traders

- Enhanced market resilience through increased liquidity provision

However, research also indicates that algorithmic trading may contribute to increased short-term volatility during extreme market events, with high-frequency trading algorithms potentially amplifying price movements during periods of market stress.

According to data from the Bank for International Settlements, algorithmic trading now accounts for:

- 73% of U.S. equity trading volume

- 65% of European equity trading volume

- 56% of futures trading globally

- 45% of foreign exchange trading volume

- 32% of fixed income trading volume

These statistics highlight the dominant role algorithmic trading has assumed across all major asset classes and markets.

Conclusion

Algorithmic trading represents one of the most significant technological transformations in financial market history. The implementation of sophisticated algorithmic trading platforms delivers quantifiable benefits, including reduced transaction costs, enhanced execution quality, improved risk management, and increased operational efficiency.

Research consistently demonstrates that organizations implementing well-designed algorithmic trading systems achieve measurable performance advantages, with studies documenting improvements in execution costs, risk-adjusted returns, and operational efficiency. The continuing evolution of artificial intelligence, machine learning, and cloud computing technologies promises to further accelerate algorithmic trading innovation and adoption.

For market participants seeking to maintain competitive positioning in increasingly technology-driven financial markets, investment in robust algorithmic trading capabilities represents a strategic imperative rather than an optional enhancement. The statistical evidence clearly establishes that algorithmic trading has progressed from experimental technology to essential infrastructure for successful market participation.

Frequently Asked Questions

How does algo trading software integrate with Zerodha and TradingView?

Algo trading software works together with platforms like Zerodha and TradingView by using APIs, which are kind of like bridges. These bridges let the algo trading tools connect to and make trades on these platforms smoothly, ensuring they can get updates instantly without any hiccups.

What are the benefits of using AI in algo trading software?

Using AI in algo trading software brings a lot of perks, like better results when you trade, spot-on guesses about the market, and smarter ways to plan your trades. With AI algorithms digging through tons of data to find patterns and trends, traders get a big help in making choices that can really up their game and boost their chances of making more money.

Can I trade multiple asset classes with algo trading software?

Indeed, algo trading software gives traders the chance to deal with a variety of asset classes like stocks, futures, options, and cryptocurrencies. By doing so, it opens up ways for traders to spread out their investments across different financial markets and grab hold of various trading opportunities that come along.

How important is backtesting in algo trading?

In algo trading, backtesting plays a key role because it lets traders use historical data to see how well their trading strategies would have done. By doing this, they can spot any possible problems, fine-tune the settings of their trades, and figure out both how profitable their methods could be and how good they are at managing risks.