Introduction to Paper Trading

The financial markets represent a complex ecosystem where fortunes can be made or lost based on strategy, discipline, and market knowledge. In this high-stakes environment, preparation is not just beneficial—it’s essential. This is where paper trading emerges as an invaluable tool for traders at every experience level.

Paper trading, also known as virtual trading or simulated trading, allows investors to practice trading strategies without risking actual capital. It creates a risk-free environment where traders can execute simulated trades using real-time market data, helping them understand market dynamics, test hypothetical scenarios, and refine their approach before committing real funds.

For the Indian market specifically—characterized by its unique volatility patterns, regulatory framework, and diverse asset classes—proper preparation through paper trading has become increasingly crucial for sustainable success.

The Indian Trading Landscape

India’s financial markets have undergone a remarkable transformation over the past two decades. With the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) ranking among the world’s top exchanges by trading volume, Indian markets now attract both domestic and international participants like never before.

Several factors make the Indian trading environment distinctive:

- High volatility: Indian markets often experience significant price swings, creating both opportunities and challenges

- Diverse participant base: From institutional investors to retail traders, the market accommodates various trading philosophies

- Regulatory evolution: Continuous regulatory refinements by SEBI have improved market structure and transparency

- Growing derivatives market: India’s F&O segment has expanded dramatically, offering sophisticated trading instruments

- Algorithmic trading growth: Technology-driven trading strategies are becoming increasingly mainstream

These characteristics make paper trading particularly valuable for anyone looking to navigate the Indian financial landscape effectively.

Why Every Trader Needs Paper Trading Experience

The benefits of paper trading extend far beyond simply learning the mechanics of placing orders. Here’s why it forms a critical component of trading education:

Risk-Free Market Exposure

Paper trading allows traders to experience authentic market conditions without the psychological pressure of potential financial loss. This creates an ideal learning environment where mistakes become valuable lessons rather than costly errors.

Strategy Development and Optimization

Every successful trader has a well-defined strategy that aligns with their financial goals, risk tolerance, and market outlook. Paper trading provides the perfect laboratory to develop these strategies, test various hypotheses, and refine approaches based on simulated performance data.

Building Trading Discipline

Perhaps the most challenging aspect of trading is maintaining emotional discipline. Paper trading helps traders develop and internalize essential habits:

- Following predefined entry and exit rules

- Managing position sizes appropriately

- Adhering to risk management guidelines

- Avoiding impulsive decisions during market volatility

Understanding Market Mechanics

Paper trading reveals crucial market dynamics that aren’t obvious from theoretical study alone:

- How orders get filled during different market conditions

- The impact of slippage on execution quality

- Volume-price relationships across various timeframes

- Correlation patterns between different assets

Technology Familiarization

Modern trading platforms offer sophisticated features that require practice to master. Paper trading allows traders to become comfortable with charting tools, order types, and analytical features before using them in live trading scenarios.

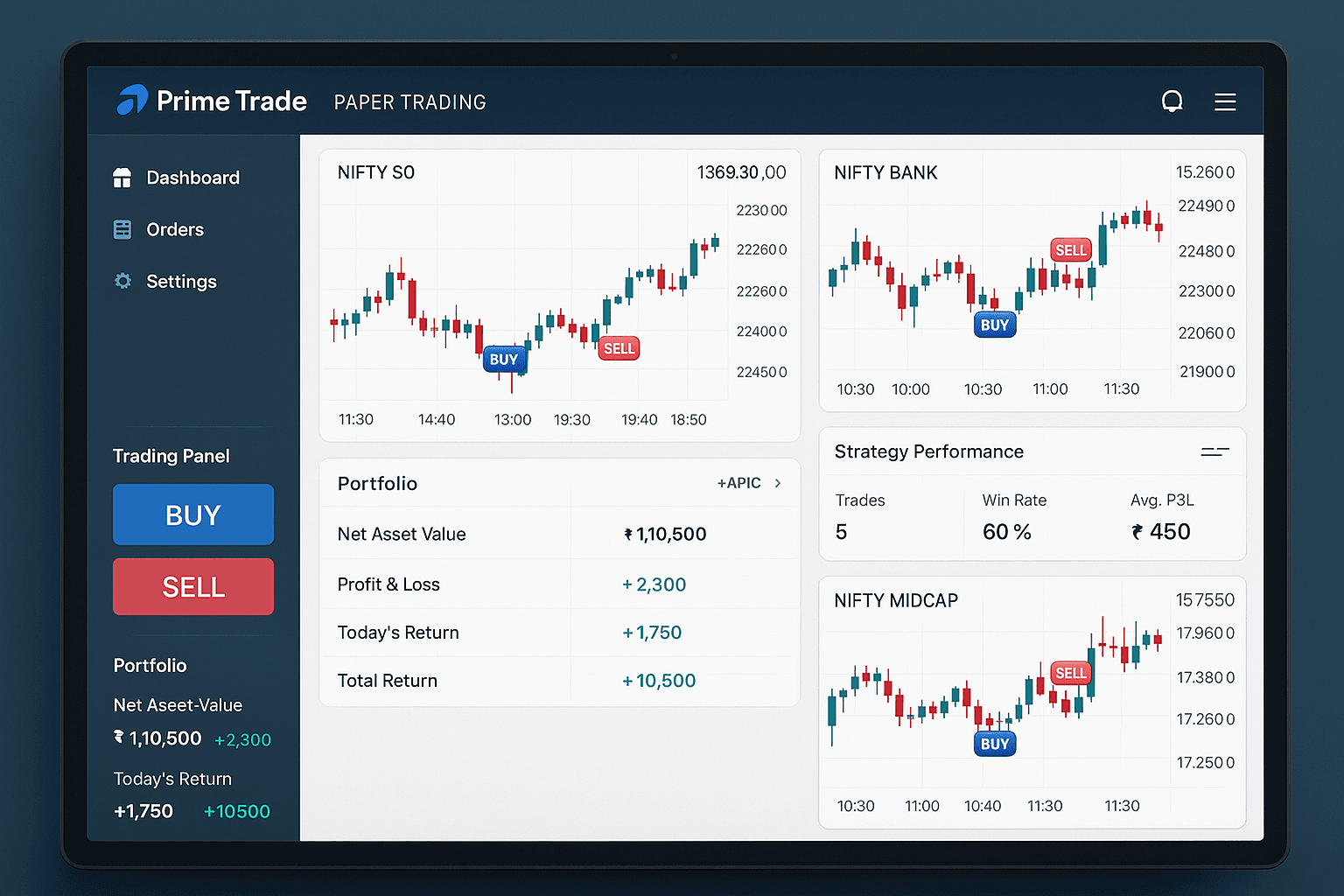

Prime Trade Pro: Revolutionizing Paper Trading in India

While several paper trading solutions exist in the market, Prime Trade Pro has emerged as the definitive leader for Indian traders seeking an authentic, comprehensive simulation environment.

Founded by a team of veteran traders and technology experts, Prime Trade Pro was designed specifically with the nuances of Indian markets in mind. The platform bridges the gap between theoretical trading knowledge and practical application, offering an ecosystem that closely mirrors real trading conditions.

What truly distinguishes Prime Trade Pro is its commitment to accuracy. Many paper trading platforms suffer from oversimplified executions that fail to account for real-world factors like slippage, partial fills, and order book dynamics. Prime Trade Pro, by contrast, incorporates these elements to create a genuinely realistic trading experience.

Advanced Features That Set Prime Trade Pro Apart

Multi-Asset Trading Simulation

Prime Trade Pro offers comprehensive coverage across asset classes:

- Equities: All stocks listed on NSE and BSE

- Futures and Options: Index derivatives including Nifty, Bank Nifty, and Midcap

- Commodity Derivatives: MCX instruments including gold, silver, and crude oil

- Currency Futures: Major currency pairs traded on Indian exchanges

- Crypto Simulations: Practice cryptocurrency trading strategies (for educational purposes)

Intuitive Strategy Builder

The platform’s proprietary no-code strategy builder democratizes algorithmic trading. Users can:

- Create rule-based trading strategies using a visual interface

- Incorporate technical indicators, price patterns, and fundamental data

- Define precise entry and exit conditions without programming knowledge

- Implement position sizing and risk management parameters

Comprehensive Backtesting Engine

Every trading idea deserves rigorous historical validation:

- Test strategies against years of historical data

- Analyze performance across different market regimes

- Examine detailed metrics including drawdowns, Sharpe ratio, and win rates

- Refine parameters based on historical performance

Advanced Analytics Dashboard

Knowledge is power in trading, and Prime Trade Pro delivers:

- Real-time performance tracking across multiple strategies

- Detailed trade journals with execution analytics

- Risk exposure analysis by sector, asset class, and strategy type

- Interactive P&L visualizations and equity curves

Seamless Transition to Live Trading

When you’re ready to convert paper success to real profits:

- One-click deployment from paper to live trading

- Integration with major Indian brokerages

- Consistent interface between paper and live environments

- Performance comparison between simulated and actual results

The Learning Journey: From Novice to Pro

Prime Trade Pro recognizes that traders progress through distinct developmental stages. The platform offers customized resources for each level:

For Beginners

- Guided interactive tutorials on platform navigation

- Basic strategy templates for initial experimentation

- Fundamental concepts explained through practical examples

- Risk-free environment to build confidence

For Intermediate Traders

- More sophisticated strategy building tools

- Sector-specific trading approaches

- Risk management workshops and simulations

- Performance analytics to identify improvement areas

For Advanced Traders

- Complex multi-factor strategy development

- Portfolio-level risk optimization tools

- Advanced execution algorithm simulations

- API access for custom integrations

Getting Started with Prime Trade Pro

Beginning your paper trading journey with Prime Trade Pro is straightforward:

- Register an Account: Visit the Prime Trade Pro website and complete the simple registration process

- Access the Paper Trading Module: Activate your virtual trading account with ₹1 lakhs in simulated capital

- Explore the Platform: Take the interactive tour to familiarize yourself with key features

- Build Your First Strategy: Use the strategy builder or select from template strategies

- Monitor and Refine: Track performance, analyze results, and continuously improve

- Join the Community: Connect with fellow traders through Prime Trade Pro’s forums and webinars

- Transition When Ready: Move to live trading only when your paper trading results show consistent profitability

Frequently Asked Questions

Q: How realistic is the paper trading simulation compared to actual market conditions?

A: Prime Trade Pro provides one of the most realistic simulations available, incorporating factors like slippage, market depth, and authentic fill algorithms based on historical order book data.

Q: Can I use Prime Trade Pro for options trading strategies?

A: Absolutely. The platform offers complete options chain data and specialized tools for options strategies including spreads, straddles, strangles, and complex multi-leg positions.

Q: Do I need programming knowledge to create strategies on Prime Trade Pro?

A: No programming experience is required. The visual strategy builder uses an intuitive interface that allows traders to create sophisticated strategies through simple logical building blocks.

Q: How long should I paper trade before going live?

A: This varies by individual, but we recommend maintaining consistent profitability over at least 30-50 trades and through different market conditions before transitioning to live trading.

Q: Can I import my existing trading strategies into Prime Trade Pro?

A: Yes, Prime Trade Pro supports strategy import through various formats including Excel templates, Pine Script, and API integration for advanced users.