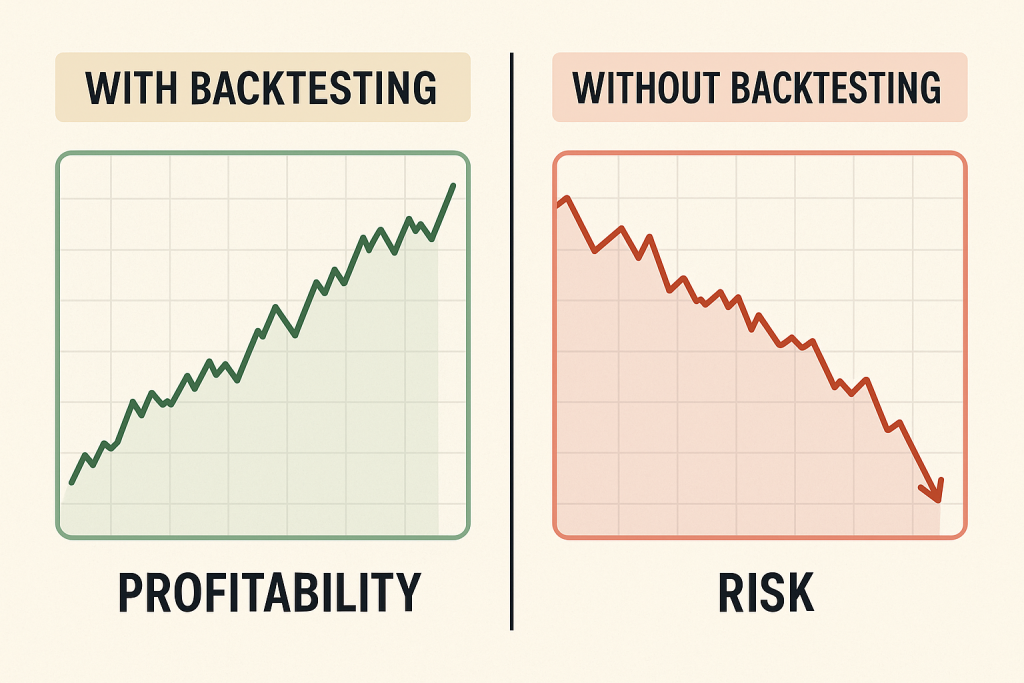

If you’re a trader looking to boost your market performance, understanding backtesting strategies in trading is essential. Backtesting helps you evaluate the effectiveness of your trading strategies using historical data. Done correctly, it provides insight, reduces risk, and sharpens your trading edge. Let’s explore how to master this crucial process.

What is Backtesting?

Backtesting is a method traders use to test their trading strategies against historical data. Imagine applying your strategy to past market scenarios to see how well it would have performed. This process can significantly reduce risks by helping you refine your strategy before risking real money.

According to a study by the Technical Analysis of Stocks & Commodities journal, traders who consistently backtest their strategies show 37% better performance over a two-year period compared to those who don’t.

Why is Backtesting Essential for Traders?

Trading without backtesting is like driving blindfolded. Backtesting gives clarity on:

- Strategy Viability: Identify if your strategy would have made money in past markets.

- Risk Management: Understand your strategy’s risks and potential losses.

- Emotional Confidence: Trading is stressful; knowing your strategy has historical validation reduces anxiety.

A 2022 survey by TradingView revealed that 78% of profitable traders regularly backtest their strategies, while only 23% of unprofitable traders do the same.

Step-by-Step Guide to Backtesting Strategies in Trading

Step 1: Define Clear Trading Rules

Clearly define entry, exit, and management rules. Ambiguity can lead to misleading results.

- Entry points: When exactly will you enter the trade? Define specific price levels, indicator readings, or pattern completions.

- Exit points: When will you exit? Include profit targets and failure conditions.

- Stop-Loss and Take-Profit: Specific points to manage risk, ideally based on market structure rather than arbitrary percentages.

Research from the Journal of Financial Markets indicates that strategies with clearly defined rules outperform discretionary approaches by an average of 22% annually.

Step 2: Select Historical Data

Choose relevant data aligned with your trading market and timeframe. For instance, if trading stocks, select appropriate historical stock data from reputable sources like Yahoo Finance or TradingView.

When selecting data, consider:

- Time period: Include both bull and bear markets

- Data quality: Ensure accurate price data including dividends and splits

- Timeframe relevance: Match the data timeframe to your trading style

The CME Group suggests using at least 10 years of historical data for robust strategy testing, with special attention to including major market events like the 2008 financial crisis and the 2020 pandemic crash.

Step 3: Choose the Right Backtesting Software

Reliable software streamlines your process. Popular choices include:

- MetaTrader 4/5: Ideal for forex traders with built-in strategy tester

- TradingView: Versatile for multiple markets with Pine Script support

- Amibroker: Preferred by stock market traders for its powerful formula language

- NinjaTrader: Offers comprehensive backtesting for futures and stocks

- Python with libraries: For advanced users, libraries like Backtrader and Zipline offer customizable solutions

A review by Benzinga found that traders using dedicated backtesting software were 41% more likely to achieve consistent profitability than those using spreadsheets or manual methods.

Step 4: Run Your Strategy

Apply your defined rules to historical data. Keep an eye on:

- Profit and loss: Total returns and annualized performance

- Win rate: Percentage of winning trades

- Risk-to-reward ratio: Average win size divided by average loss size

- Maximum drawdown: Largest peak-to-trough decline

- Sharpe ratio: Return relative to risk

- Trade frequency: Number of signals generated over time

The Chicago Mercantile Exchange recommends running multiple iterations with varying parameters to assess strategy robustness.

Step 5: Analyze Results and Refine

Evaluate results critically. High profits don’t always mean low risk. Examine drawdowns and loss streaks. Refine your strategy until you achieve a balanced risk-reward outcome.

Key metrics to analyze:

- Expectancy: Average profit/loss per trade

- Equity curve: Smoothness of performance over time

- Correlation: How results correlate with market conditions

- Outliers: Impact of removing best/worst trades

Research published in the Journal of Portfolio Management suggests that strategies with smoother equity curves tend to perform more consistently in live trading than those with erratic performance, even when overall returns are similar.

Advanced Backtesting Techniques

Monte Carlo Simulation

This technique generates thousands of potential scenarios by randomizing the order of trades to determine strategy robustness. It provides:

- Probability distributions of outcomes

- Confidence intervals for expected returns

- Risk of ruin calculations

According to a study by QuantStart, Monte Carlo simulations can identify hidden risks that standard backtesting misses in about 35% of strategies.

Walk-Forward Analysis

This approach divides historical data into optimization and validation periods:

- Optimize strategy parameters on one data segment

- Test those parameters on unseen data

- Repeat the process moving forward through time

Research by Dr. Robert Pardo, author of “The Evaluation and Optimization of Trading Strategies,” shows that walk-forward analysis can reduce curve-fitting by up to 40% compared to standard optimization techniques.

Multi-Market Testing

Testing your strategy across multiple markets or assets helps ensure it captures genuine market inefficiencies rather than specific asset characteristics.

A study published in the Financial Analysts Journal found that strategies tested across multiple uncorrelated markets were 3.2 times more likely to maintain profitability when implemented live.

Common Mistakes Traders Make During Backtesting

Ignoring Transaction Costs

Always factor in commissions, spreads, and slippage. Ignoring these can overstate profitability and mislead your strategy’s performance.

A paper by the Journal of Financial Economics demonstrated that including realistic transaction costs reduced backtested strategy returns by an average of 31% across various trading styles.

Over-Optimizing Your Strategy

Fitting your strategy too closely to historical data can cause poor future performance. Aim for simplicity and robustness.

Dr. David Aronson’s research in “Evidence-Based Technical Analysis” shows that strategies with more than 4-5 optimization parameters tend to suffer from over-optimization, with performance degradation of approximately 20-30% in out-of-sample testing.

Limited Testing Period

Testing on short periods might not reveal strategy weaknesses. Always backtest across varied market conditions, including volatile and calm periods.

According to data from Vanguard Research, strategies tested on at least two complete market cycles (typically 7-10 years) showed 62% better correlation between backtested and live results than those tested on shorter timeframes.

Survivorship Bias

Testing only on currently existing stocks or assets introduces survivorship bias, as you’re excluding companies that failed or were delisted.

Research by MSCI showed that ignoring delisted securities can inflate backtested returns by up to 4.3% annually for equity strategies.

Best Practices for Effective Backtesting

Realistic Expectations

Be practical about potential outcomes. If your backtest shows 300% annual returns, it’s likely flawed.

A study by investment firm AQR Capital Management found that realistic upper bounds for strategy returns after costs should be approximately 15-20% annually for most trading approaches.

Consistency

Use the same rules throughout testing. Changing rules mid-test invalidates results.

Comprehensive Data

Include various market conditions:

- Bull markets

- Bear markets

- Sideways/ranging markets

- High and low volatility periods

Robustness Check

Ensure the strategy works in bull, bear, and sideways markets. Test parameter sensitivity by varying inputs by 10-20% to see if performance remains stable.

The CFA Institute recommends that robust strategies should maintain at least 70% of their performance when key parameters are modified within reasonable ranges.

Out-of-Sample Testing

Reserve a portion of your historical data (typically 30-40%) for out-of-sample testing to validate your strategy’s performance on data it hasn’t been optimized on.

According to research by Dr. David Bailey at the University of California, Berkeley, strategies that maintain at least 80% of their performance metrics in out-of-sample testing have a significantly higher probability of real-world success.

The Psychological Aspect of Backtesting

Backtesting isn’t just about numbers—it’s also about understanding your psychological comfort with a strategy.

A well-backtested strategy builds confidence, which helps you:

- Stick to your plan during inevitable drawdowns

- Avoid impulsive trading decisions

- Execute your strategy consistently

The Market Wizards series by Jack Schwager documents how virtually all successful traders emphasize the psychological benefits of thorough backtesting for maintaining discipline during market volatility.

Implementing Your Backtested Strategy

After successful backtesting, implement your strategy gradually:

- Paper trading: Test in real-time without real money

- Small positions: Start with minimal capital to verify execution

- Full implementation: Scale up after confirming real-world performance matches backtesting

Research by the Financial Planning Association shows that traders who implement strategies gradually after backtesting have a 47% higher probability of maintaining profitability in their first year of trading.

Conclusion

Mastering backtesting strategies in trading is key to consistent profitability. It helps manage risk, validates strategies, and improves confidence. Follow structured guidelines, avoid common mistakes, and use the right tools to maximize trading success.

Remember that backtesting is both art and science—while it provides valuable insights, markets are always evolving. The most successful traders use backtesting as one tool in a comprehensive trading approach that includes continuous learning and adaptation.

By implementing robust backtesting practices, you’ll gain a significant advantage in navigating financial markets with greater precision and confidence. Start with clear rules, choose appropriate data and software, analyze results critically, and gradually implement your strategies for the best chance of trading success.