Algorithmic trading (or algo trading) has revolutionized how traders interact with financial markets. These sophisticated platforms automate trading based on predefined rules, offering real-time market analysis and risk management tools to maximize profits while minimizing losses. In India’s evolving financial landscape, several platforms have emerged as leaders in the algo trading space, catering to both novices and experienced traders with their user-friendly interfaces and advanced customization options.

Introduction

The rise of algorithmic trading represents a significant shift in financial markets. By leveraging computer programs to execute trades with speed and efficiency beyond human capabilities, algo trading has become essential for professional traders and serious investors looking to optimize their performance in the stock market.

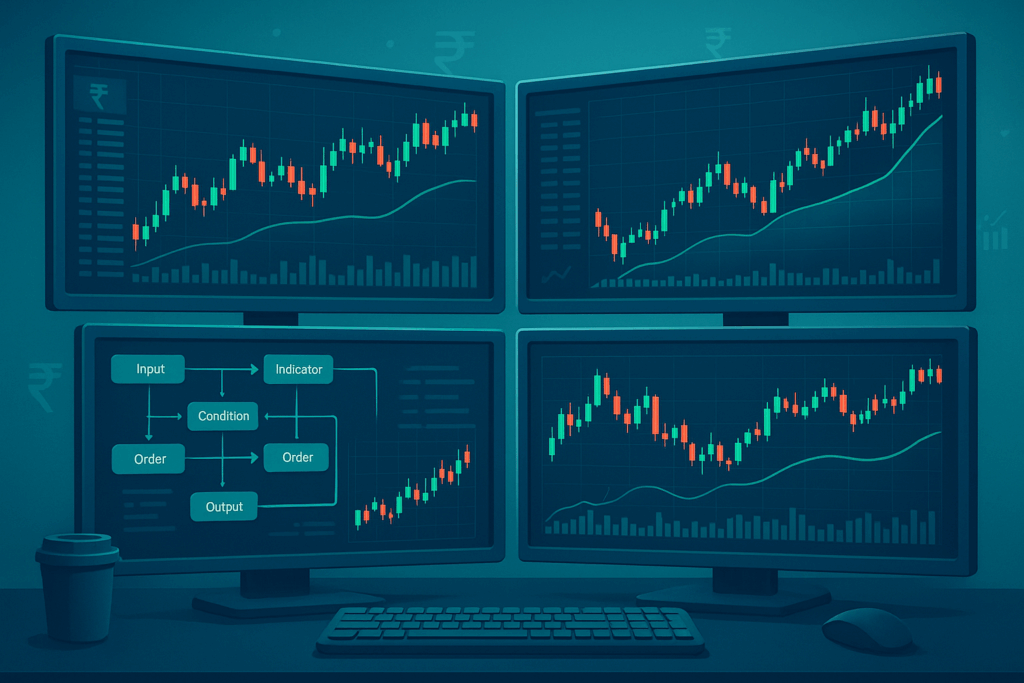

Quality algo trading software serves as the backbone of successful trading operations. These platforms enable traders to program their strategies according to specific parameters, offering real-time market analysis, risk management features, and customizable options to suit individual trading styles.

India’s fintech ecosystem offers a diverse range of algo trading solutions, each with unique strengths depending on trader experience and investment capacity. Let’s explore the top 10 algo trading platforms making waves in India’s market in 2024.

Exploring the 10 Top Algo Trading Platforms in India

The following platforms stand out in India’s algo trading landscape, offering intuitive interfaces, robust technical analysis tools, and seamless connectivity with various stock exchanges.

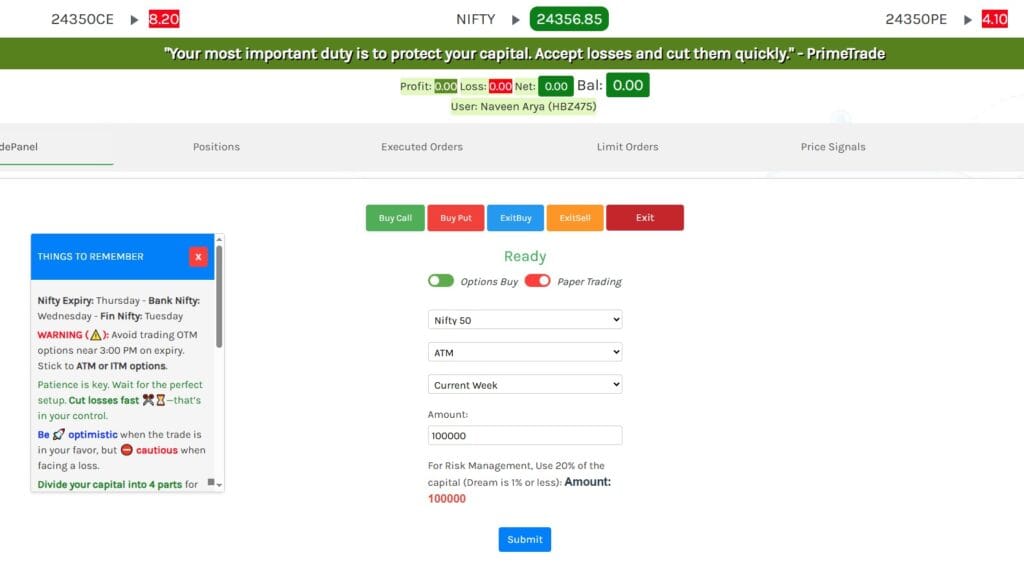

1. Prime Trade Pro – Leading the Way in User-Friendly Algo Trading

Prime Trade Pro has established itself as the frontrunner in India’s algo trading space, particularly for beginners entering the world of automated trading. Its intuitive, visually appealing interface features a drag-and-drop strategy builder that eliminates the need for complex coding knowledge.

What sets Prime Trade Pro apart is its simplicity in setting up and managing algorithmic trades. The visual strategy builder allows traders to customize their approaches based on technical indicators or price movements without getting bogged down in technical details. With access to live market data, traders can make informed decisions quickly and confidently.

The platform includes essential risk management tools like stop-loss and take-profit options to protect investments. Before committing real capital, traders can backtest strategies against historical data or practice with virtual funds. The mobile app ensures traders stay connected on the go, making Prime Trade Pro a top choice for algo trading enthusiasts in India.

2. Upstox Algo Lab – Innovating with Integration and Ease of Use

Upstox Algo Lab stands out for its seamless integration and user-friendly approach to algo trading. The platform offers a clean interface and pre-designed strategies that simplify the development and testing process for algorithmic trading strategies.

Its intuitive design caters especially to beginners, allowing traders to create algo trading strategies without extensive coding knowledge. The drag-and-drop strategy builder with visual elements makes algo creation accessible to traders of all experience levels.

Upstox Algo Lab provides pre-designed strategies and technical indicators to support strategy development. Traders can backtest their ideas using historical data to evaluate potential profitability before risking real capital. The platform also offers simulated trading environments for risk-free practice.

The platform integrates smoothly with the broader Upstox trading ecosystem, allowing for mobile monitoring of market conditions and strategy performance. With a free basic plan available, Upstox Algo Lab combines innovation with accessibility, making it a popular choice among Indian traders seeking profitability through user-friendly tools.

3. Tradetron – A New Era for Strategy Building

Tradetron is transforming algo trading in the Indian market with its user-friendly interface and innovative features. The platform allows traders to create, test, and deploy automated trading algorithms without advanced coding skills.

At its core, Tradetron excels in facilitating diverse trading strategies. Whether focusing on directional trades, building data-driven portfolios (fundamental or technical), generating steady income through trades, or exploring arbitrage opportunities across exchanges – this platform accommodates all approaches.

New users will appreciate Tradetron’s intuitive environment that simplifies complex strategy management. The platform includes risk management features like stop-loss and take-profit settings to protect investments and control risk exposure.

Tradetron’s marketplace enables traders to discover and adopt strategies created by others, expanding automated trading opportunities without starting from scratch. The platform also provides sophisticated charting tools and technical indicators for in-depth price analysis.

Tradetron represents a significant advancement in strategy development for algo trading in India, combining robust functionality with an intuitive interface that empowers traders across experience levels.

4. AlgoTraders – Advanced Solutions for Professional Traders

AlgoTraders offers a comprehensive solution for professional traders in the Indian market. The platform features advanced capabilities that enhance trading performance, including robust backtesting functionality that allows traders to evaluate strategies using historical data before implementing them in live markets.

The platform provides sophisticated charting options and technical analysis tools that help traders visualize market conditions and assess strategy performance with precision. AlgoTraders supports trading across multiple asset classes, including stocks, options, futures, and forex, giving traders significant flexibility.

Integration with external data sources, including news feeds and market data providers, ensures traders have access to real-time information critical for informed decision-making. The platform’s direct connectivity to brokerage accounts and execution platforms enables automatic order placement according to predefined strategies, streamlining the trading process.

AlgoTraders delivers a comprehensive package specifically designed for professional traders exploring algo trading in the Indian market, with tools optimized for performance across various asset classes and detailed technical analysis capabilities.

5. TradeSanta – Simplifying Automated Crypto Trading

TradeSanta specializes in making automated cryptocurrency trading accessible in the Indian market. With its intuitive interface, traders can easily automate their crypto trading strategies without constant manual intervention.

The platform’s core strength lies in its automation capabilities, enabling traders to set up trading bots using ready-made templates or custom configurations. This automation allows for 24/7 trading, helping traders capitalize on opportunities in both bull and bear markets through long and short bot options.

TradeSanta supports multiple cryptocurrency exchanges, providing access to a wide range of trading pairs. The platform offers various customizable long and short strategy options to accommodate individual trader preferences.

By streamlining automated cryptocurrency transactions, TradeSanta makes advanced crypto trading more approachable for investors in India’s emerging digital asset marketplace.

6. Robo Trader – Revolutionizing Retail Trading

Robo Trader is transforming retail trading in India with its accessible algo trading platform. Designed for traders of all experience levels, it features a visual strategy builder with drag-and-drop functionality that simplifies the creation of trading strategies.

The platform offers an extensive library of pre-built strategies for various markets and trading styles. Whether focusing on stocks, futures, options, or forex pairs, Robo Trader provides diverse investment opportunities and portfolio diversification options.

Advanced features include expert entry and exit signals, order flow data analysis for market insight, and comprehensive portfolio management tools that help traders optimize their holdings while managing risk exposure.

Robo Trader makes algorithmic trading straightforward and accessible for anyone in the Indian market, combining a user-friendly interface with sophisticated tools designed to maximize profits and minimize losses.

7. NinjaTrader – A Global Favorite for Futures and Forex

NinjaTrader has established itself as a premier choice for algo trading, particularly in futures and forex markets. The platform offers comprehensive tools and features that appeal to traders worldwide interested in these specific markets.

Specializing in futures and forex trading, NinjaTrader allows users to create highly customized charts with technical indicators for detailed market analysis. The platform supports automated strategy development, backtesting against historical data, and simulated trading for risk-free practice.

NinjaTrader streamlines order execution across different exchanges, enhancing trading efficiency. The platform also supports third-party add-ons and indicators, expanding its functionality for specialized trading approaches.

With its visual strategy builder, NinjaTrader makes automated trading accessible without requiring advanced coding skills. The platform offers simulation capabilities for practice trading and direct broker connections for efficient order execution.

Whether targeting Indian markets or pursuing global futures and forex opportunities, NinjaTrader delivers an advanced algo trading experience with features tailored to these specific trading goals.

8. Algobulls – Pioneering in Customization and Control

Algobulls stands out as a leading algo trading platform that prioritizes trader customization and control. It’s designed for traders who want to shape personalized strategies for the Indian market.

The platform emphasizes customization, allowing traders to design approaches that align with their preferences and trading style. Users can experiment with various parameters including price movements, volume patterns, and technical indicators to optimize their trading strategies.

Algobulls features an intuitive drag-and-drop strategy builder that simplifies customization. The platform also fosters community learning by enabling strategy sharing among users.

Beyond customization tools, Algobulls provides access to expert trading signals for entry and exit guidance, order flow data analysis for informed decision-making, and portfolio management tools for investment optimization and risk management.

Algobulls leads the way in providing traders complete customization and control over their algorithmic trading activities in the Indian market by offering comprehensive tools in a single platform.

9. QuantBox – Data-Driven Decisions Made Simple

QuantBox specializes in simplifying data-driven trading decisions for the Indian algo trading market. The platform features a powerful backtesting engine and historical data analysis tools that enable traders to thoroughly evaluate their strategies.

With a clear focus on data-informed decision-making, QuantBox allows traders to test strategies against historical market conditions to refine approaches before live implementation. The platform includes portfolio management tools for performance monitoring and investment adjustment using optimization features.

One of QuantBox’s standout capabilities is financial scenario simulation, which helps traders prepare for various market conditions and developments. This forward-looking approach supports more comprehensive trading strategy development.

QuantBox streamlines the process of analyzing historical data, refining strategies, and improving trading outcomes within the Indian market, making it valuable for traders focused on empirical strategy development.

10. MetaTrader 5 – A Universal Tool for Forex and Stock Markets

MetaTrader 5 offers versatility for both forex and stock market trading, with features tailored to the Indian market. Known for its adaptability, the platform provides traders with customizable charts, technical indicators, and automated strategy execution capabilities.

The platform’s multi-market approach allows traders to diversify across forex and stocks, supporting various order types and strategies to accommodate different trading styles. MetaTrader 5 extends its functionality with services like copy trading, strategy development data, virtual hosting for operational efficiency, and automated trading bots.

For traders seeking additional customization, the platform supports third-party tools and indicators. MetaTrader 5 delivers a comprehensive suite of tools specifically designed for the diverse needs of traders in the Indian market, making it a universal solution for both forex and stock market participants.

Conclusion

Algorithmic trading in India offers tremendous potential for traders prioritizing speed, accuracy, and consistent execution. Understanding the fundamentals of algo trading and selecting the appropriate platform are crucial steps toward trading success. As SEBI regulations provide a framework for operation, establishing a personalized algo trading setup can yield significant benefits. With emerging technologies like AI and machine learning reshaping trading methodologies, staying informed and adaptable is essential. Whether you’re an experienced trader or just beginning your journey, exploring the capabilities of algorithmic trading can substantially enhance your trading outcomes.