The financial markets never sleep, constantly shifting between periods of growth, decline, and sideways movement. For investors and traders alike, understanding what drives these market movements is the difference between capitalizing on opportunities and watching them slip away.

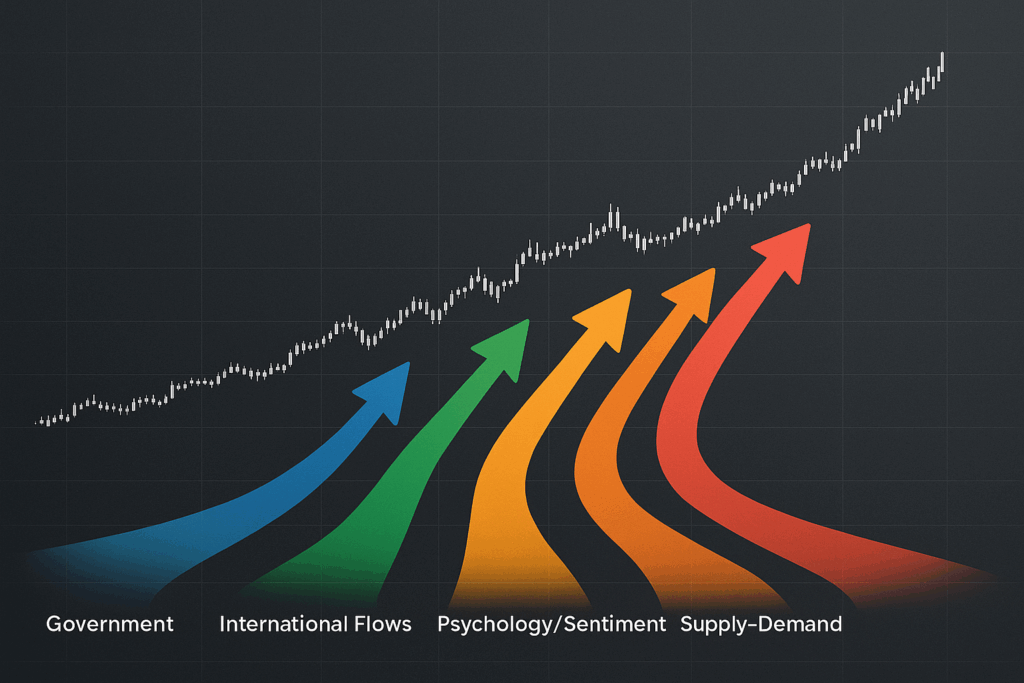

Whether you’re planning long-term investments or executing short-term trades, market trends determine your success. But what exactly creates these trends? The answer lies in four fundamental forces that shape every market movement you see.

The Foundation of Market Analysis

Every price movement in the financial markets stems from the interplay of four critical elements. These forces work both independently and together, creating the complex tapestry of market behavior that investors navigate daily.

Understanding these elements provides a roadmap for anticipating future market directions and making informed investment decisions.

Government Influence: The Policy Powerhouse

Governments wield enormous influence over market direction through their policy decisions. When central banks adjust interest rates or governments modify spending patterns, the ripple effects flow through every corner of the financial world.

- Monetary Policy Impact Central banks like the Federal Reserve control the flow of money through interest rate adjustments. Lower rates typically encourage borrowing and spending, fueling economic growth and often pushing asset prices higher. Conversely, higher rates can cool overheated markets by making borrowing more expensive.

- Fiscal Policy Effects Government spending and taxation policies directly impact economic activity. Increased government expenditure can stimulate growth and reduce unemployment, while tax modifications alter how much money individuals and businesses have available for investment.

These policy shifts create immediate market reactions as investors quickly price in expected changes. A surprise interest rate cut might send stocks soaring within hours, while unexpected tax increases could trigger sell-offs across multiple sectors.

Global Money Flows: The International Dimension

Money constantly moves across borders, seeking the best returns and most stable environments. This international capital flow significantly impacts both individual countries and global markets.

- Currency Strength Indicators Countries that consistently export goods and services attract foreign currency, strengthening their domestic economy. This incoming capital can fuel domestic investment and boost local financial markets.

- Investment Climate Effects A strong currency attracts foreign investment, as international investors face less currency risk. However, a weakening currency can deter foreign capital, potentially leading to market declines as money flows elsewhere.

The interconnected nature of global markets means that economic events in one major economy can quickly spread worldwide, creating opportunities and risks across international markets.

Market Psychology: The Human Element

Perhaps the most fascinating aspect of market behavior is how human emotions and expectations drive price movements. Market participants’ collective beliefs about future conditions often become self-fulfilling prophecies.

- Sentiment Analysis Investor confidence surveys, consumer spending patterns, and business investment plans all provide insights into market sentiment. When optimism prevails, markets tend to rise as participants expect good times ahead. Pessimism has the opposite effect.

- Expectation Management Current market behavior often reflects what investors believe will happen in the future. If most market participants expect economic growth, they buy stocks today, pushing prices higher and potentially creating the very growth they anticipated.

This psychological component explains why markets sometimes move dramatically on news that doesn’t immediately change fundamental economic conditions.

Supply and Demand: The Market’s Natural Law

At its core, every market operates on the basic principle of supply and demand. When more people want to buy than sell, prices rise. When selling pressure exceeds buying interest, prices fall.

- Commodity Markets In physical commodity markets, supply constraints can create dramatic price movements. Limited oil production or poor agricultural harvests can send prices soaring as buyers compete for scarce resources.

- Financial Markets Stock markets operate similarly. When investors rush to buy shares of a promising company, limited share supply drives prices higher. Mass selling creates the opposite effect, pushing prices down as supply overwhelms demand.

- Price Discovery Process This constant push and pull between buyers and sellers creates an ongoing price discovery process, where market prices adjust continuously to reflect changing supply and demand conditions.

How These Forces Interact

While each factor operates independently, their true power emerges from their interconnections. Government policy decisions influence international money flows, which affect market sentiment, which ultimately drives supply and demand dynamics.

- Short-Term Market Reactions Breaking news about government policy changes can create immediate buying or selling pressure as traders react quickly to new information. These rapid responses often create short-term price volatility and temporary trend changes.

- Long-Term Trend Development More substantial trends develop as investors fully digest new information and adjust their strategies accordingly. A series of positive economic indicators might create a sustained upward trend lasting months or years.

- Market Cycle Recognition Understanding how these factors interact helps investors recognize different phases of market cycles, from bull markets driven by optimism and growth to bear markets characterized by pessimism and declining economic conditions.

Practical Applications for Investors

Successful investing requires monitoring all four factors simultaneously while understanding their current relative importance.

- News Analysis Stay informed about government policy announcements, international economic developments, and changes in market sentiment. Each piece of information provides clues about potential market direction.

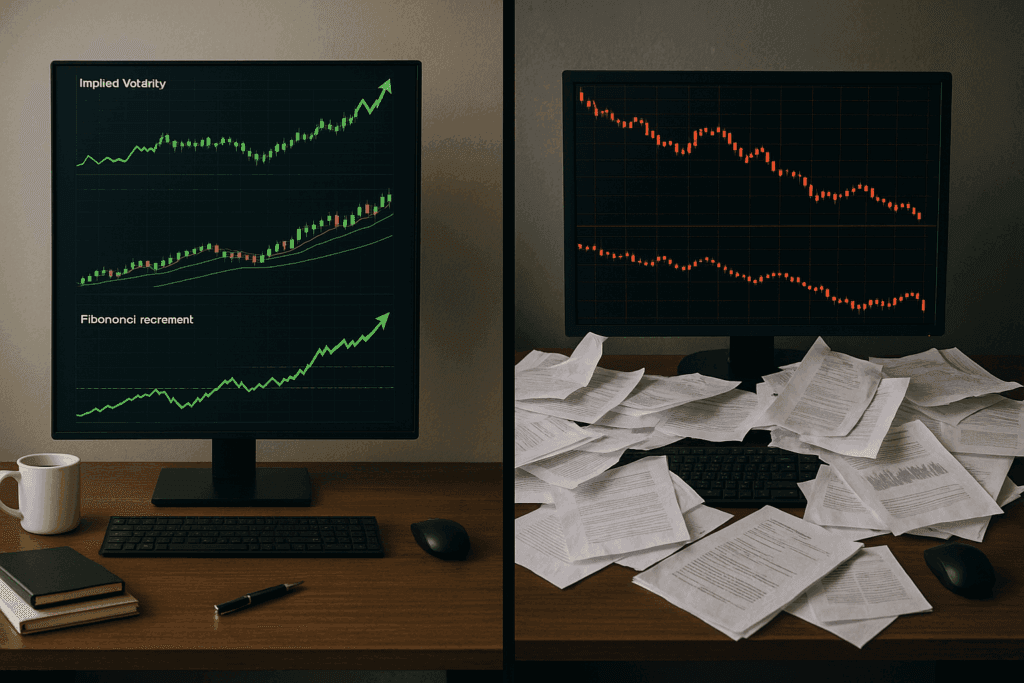

- Technical Indicators Use technical analysis tools like moving averages and momentum indicators to identify when trends are beginning, continuing, or potentially reversing.

- Risk Management Remember that markets can change direction quickly when multiple factors align. Diversification and proper position sizing help protect against unexpected trend reversals.

The Trend Advantage

Markets trend upward more often than downward over long periods because economies generally grow over time. However, recognizing when temporary downtrends might occur allows investors to protect capital and identify buying opportunities.

- Bull Market Characteristics Rising trends typically feature consistent buyer interest, positive economic indicators, and optimistic investor sentiment. These conditions can persist for years when fundamental factors remain supportive.

- Bear Market Signals Declining trends often emerge when multiple negative factors converge: restrictive government policies, economic weakness, pessimistic sentiment, and selling pressure overwhelming buying interest.

Building Your Market Understanding

Developing expertise in market trend analysis requires continuous learning and observation. Start by focusing on one or two factors that most interest you, then gradually expand your analysis to include all four elements.

The most successful investors and traders understand that markets are complex systems where multiple forces constantly interact. By studying these interactions and their historical patterns, you can develop the insights needed to navigate future market movements successfully.

Remember: while these four factors provide a framework for understanding market behavior, markets can still surprise even experienced professionals. The key is using this knowledge to make more informed decisions while maintaining appropriate risk management practices.

The financial markets offer both opportunities and risks. Understanding the forces that drive market trends provides a foundation for making informed investment decisions, but always consider your personal financial situation and risk tolerance before making investment choices.