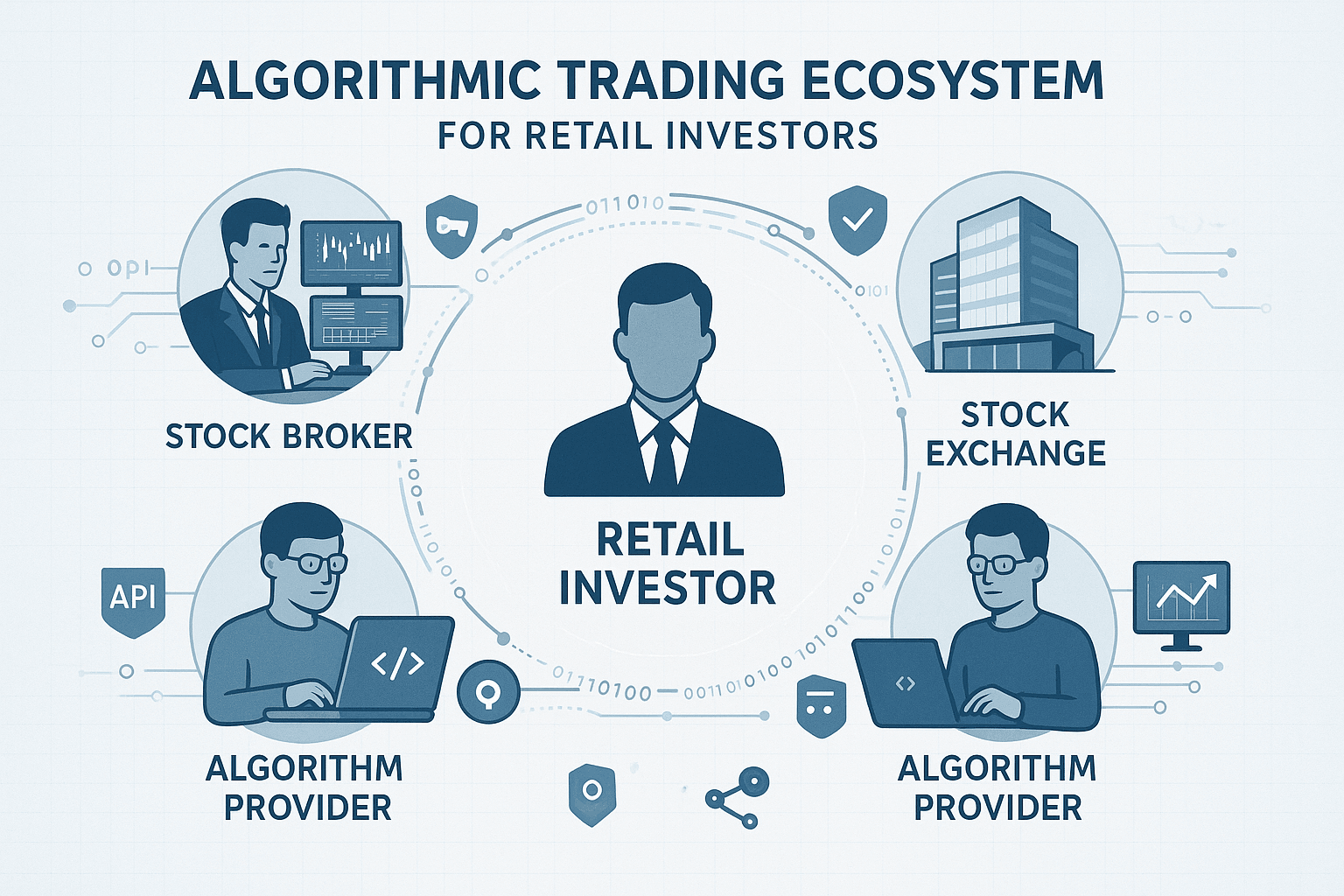

The Securities and Exchange Board of India (SEBI) is pleased to introduce a refined regulatory framework that will enable retail investors to safely participate in algorithmic trading. This initiative builds upon our previous guidelines while creating a balanced ecosystem that protects investors and maintains market integrity.

Algorithmic trading offers significant advantages through timed and programmed order execution. While institutional investors have long benefited from algorithmic trading via mechanisms like Direct Market Access, there has been growing demand from retail investors to access these tools. This circular establishes a comprehensive framework that defines the rights and responsibilities of all stakeholders—investors, brokers, algorithm providers, and Market Infrastructure Institutions.

Key Framework Components

1. API Access for Algorithmic Trading

- Principal-Agent Relationship: Brokers will serve as principals while algorithm providers or fintech vendors will act as their agents when using broker-provided APIs

- Order Tagging: All algorithmic orders flowing through APIs must carry a unique identifier assigned by the Stock Exchange

- Self-Developed Algorithms: Tech-savvy retail investors who create their own algorithms must register them with the Exchange (through their broker) if order frequency exceeds specified thresholds

- Such registered algorithms may be used by the investor’s family members (defined as spouse, dependent children, and dependent parents)

- Broker Requirements:

- Implement systems to identify all orders above specified thresholds as algorithmic orders

- Prohibit open APIs; allow access only through unique vendor-client specific API keys

- Enforce static IP whitelisting to ensure traceability

- Implement OAuth-based authentication with two-factor verification

- Work exclusively with empaneled algorithm providers and handle all related complaints

2. Stock Broker Responsibilities

Brokers offering algorithmic trading facilities must:

- Obtain Exchange permission for each algorithm before deployment

- Ensure all algorithmic orders carry the unique Exchange-provided identifier

- Seek Exchange approval for any modifications to approved algorithms

- Take full responsibility for handling investor grievances and monitoring APIs for prohibited activities

3. Algorithm Provider Empanelment

- While algorithm providers will not be directly regulated by SEBI, they must be empaneled with Exchanges based on specified criteria

- Brokers must conduct due diligence before onboarding any empaneled algorithm provider

- Fee arrangements between algorithm providers and brokers are permitted, but complete disclosure of all charges must be made to clients

- Brokers must ensure these arrangements do not create conflicts of interest

4. Stock Exchange Oversight

Exchanges will be responsible for:

- Developing comprehensive Standard Operating Procedures for algorithm testing

- Conducting surveillance on all algorithmic orders and monitoring behavior

- Maintaining “kill switch” capability to terminate orders from specific algorithm IDs

- Defining roles and responsibilities for brokers and algorithm providers

- Establishing empanelment criteria and processes

- Verifying brokers can distinguish between algorithmic and non-algorithmic orders

- Issuing detailed operational guidelines covering:

- Broker risk management systems for API orders

- Algorithm provider roles and empanelment processes

- Algorithm registration processes and re-approval circumstances

- Confidentiality measures for retail algorithmic strategies

- Data flow management between stakeholders

- Specifying turnaround times for registering different types of algorithms (fast-track for execution algorithms, normal process for others)

5. Algorithm Categorization

Algorithms will be classified into two categories:

Category 1: White Box Algorithms (Execution Algorithms)

- Logic is disclosed and replicable

- Transparent decision-making processes and rules

Category 2: Black Box Algorithms

- Logic is not known to the user and is not replicable

- Additional requirements for providers:

- Registration as Research Analysts

- Maintenance of detailed research reports for each algorithm

- Re-registration as a new algorithm when logic changes, with updated research reports

Implementation Timeline

- April 1, 2025: Implementation standards to be formulated by the Broker’s Industry Standards Forum under Exchange guidance and SEBI consultation

- August 1, 2025: Full implementation of all provisions in the circular

Conclusion

Stock Exchanges are directed to:

- Implement necessary systems and procedures

- Amend relevant bye-laws, rules, and regulations

- Notify brokers and publish this information on their websites

This circular is issued under Section 11(1) of the Securities and Exchange Board of India Act, 1992, read with Section 30 of the Securities and Exchange Board of India (Stock Brokers) Regulations, 1992.

The complete circular is available at www.sebi.gov.in under ‘Legal → Circulars’.

This document provides a general overview of SEBI’s framework for retail algorithmic trading. Please refer to the official circular and implementation guidelines for complete details and compliance requirements.