In today’s digital-first investment landscape, understanding how to manage your securities electronically has become essential for every investor in India. If you’ve ever wondered about NSDL demat accounts and how they can streamline your investment journey, you’ve come to the right place.

Understanding NSDL: The Foundation of Digital Securities

The National Securities Depository Limited, commonly known as NSDL, represents a revolutionary step in India’s financial ecosystem. Established as the country’s pioneering depository in 1996, NSDL transformed how Indians invest by introducing electronic securities management, effectively eliminating the complexities and risks associated with physical share certificates.

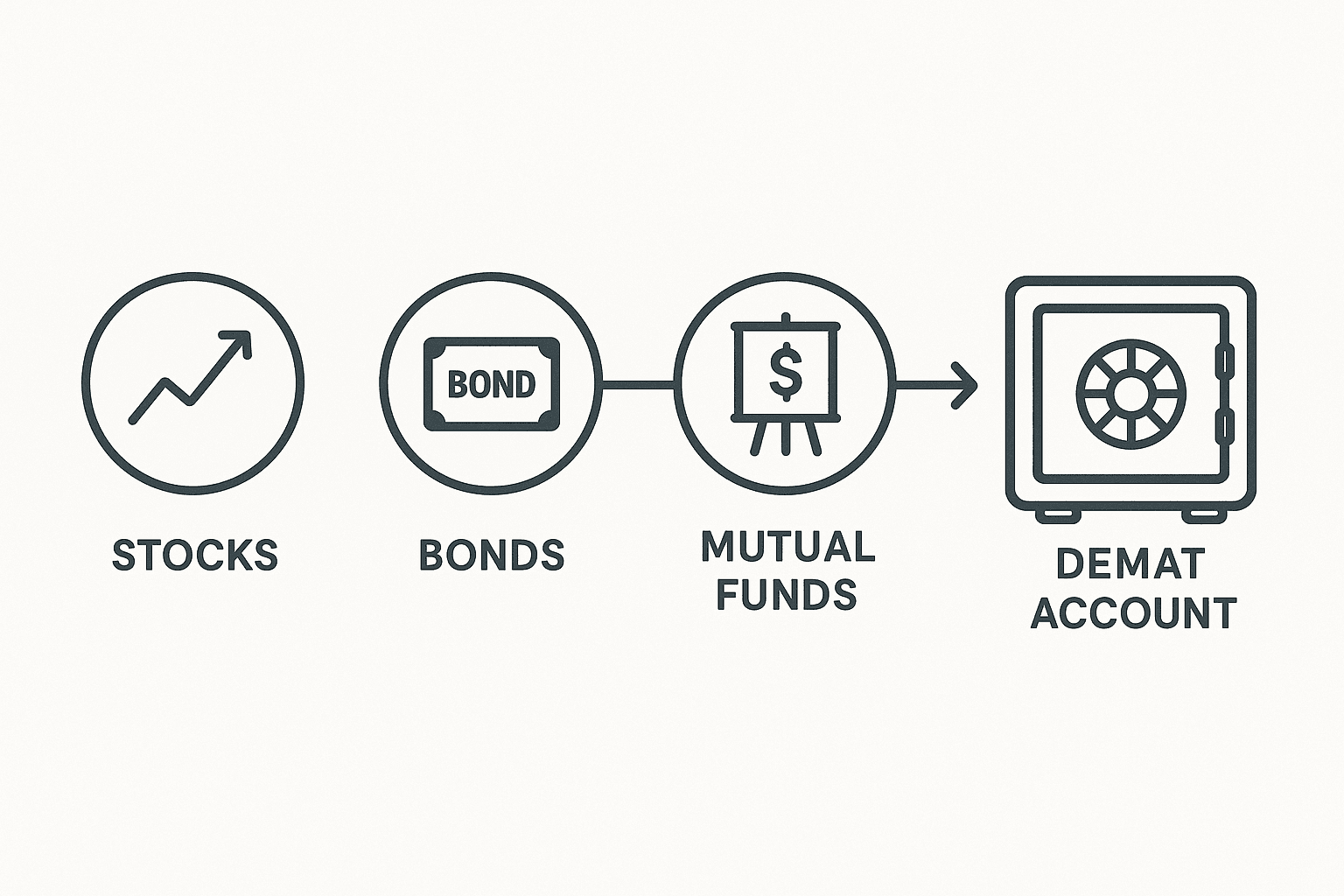

Operating under the watchful eye of the Securities and Exchange Board of India (SEBI), NSDL serves as a trusted custodian for various financial instruments including equities, debt securities, mutual funds, and exchange-traded funds. Today, having a demat account with either NSDL or its counterpart CDSL has become mandatory for anyone looking to participate in India’s stock markets.

How Your NSDL Demat Account Functions

Think of your NSDL demat account as a digital vault where all your investments are stored securely. The process begins when you approach a Depository Participant (DP) – which could be your bank, broker, or any authorized financial institution registered with NSDL.

Here’s how the system works in practice:

- Account Creation: You open your demat account through an NSDL-registered DP, who acts as your gateway to the depository system.

- Unique Identification: Every account receives a distinctive 16-digit number combining your DP’s identification code with your personal client ID, ensuring complete traceability of your holdings.

- Seamless Transactions: When you purchase securities, they’re automatically credited to your account in electronic format. Similarly, sales result in debits, with ownership transferring digitally to the buyer’s account.

- Real-time Monitoring: You can track your investments and transaction history through your DP’s platform or NSDL’s dedicated IDeAS portal, providing 24/7 access to your portfolio information.

Why NSDL Demat Accounts Are Game-Changers

The advantages of maintaining an NSDL demat account extend far beyond mere convenience:

- Enhanced Security: Your securities exist in digital format, completely eliminating concerns about physical damage, theft, or loss that plagued traditional paper certificates.

- Unified Portfolio Management: Whether you invest in stocks, mutual funds, bonds, or ETFs, everything consolidates into one easily manageable account, simplifying your investment oversight.

- Faster Settlement: Digital transactions occur much more rapidly than their physical counterparts, improving market liquidity and reducing settlement risks.

- Diverse Investment Access: Your account opens doors to various investment avenues, from government securities to corporate bonds and mutual funds.

- Future-Proofing: The nomination facility allows you to designate beneficiaries, ensuring your investments remain protected for your loved ones.

NSDL vs CDSL: Making the Right Choice

While both NSDL and CDSL offer similar core services, understanding their differences can help inform your decision:

NSDL, being the elder statesman launched in 1996, was developed through collaboration between the National Stock Exchange and leading banks. CDSL followed in 1999, backed by the Bombay Stock Exchange and various institutions.

Currently, CDSL maintains a larger active account base, primarily due to competitive pricing structures. However, your choice often depends less on the depository itself and more on your preferred brokerage, as most brokers affiliate with only one depository.

Both platforms handle trade settlements, corporate actions like dividend distributions, and rights issues with equal efficiency, so you can’t go wrong with either option.

Essential Features Every NSDL Account Holder Should Know

- Account Structure: Your 16-digit account number isn’t random – the first eight digits identify your DP, while the remaining eight represent your unique client identification.

- Digital Access: The IDeAS platform serves as your personal dashboard, offering comprehensive views of holdings, transaction histories, and downloadable statements whenever needed.

- Security Alerts: Every transaction triggers immediate email and SMS notifications, keeping you informed about all account activities in real-time.

- Regulatory Compliance: SEBI oversight ensures your investments remain protected under established legal frameworks, providing peace of mind about regulatory compliance.

- Flexible Statements: While digital access covers most needs, you can always request physical statements from your DP when required for documentation purposes.

Getting Started with Your NSDL Journey

Opening an NSDL demat account has become increasingly straightforward, with most DPs offering online account opening processes. The key is choosing a reliable DP that aligns with your investment goals and provides excellent customer service.

Remember, your demat account serves as the foundation of your investment portfolio, so take time to understand its features and capabilities. Whether you’re a seasoned investor or just beginning your financial journey, an NSDL demat account provides the secure, efficient platform you need to build wealth in India’s dynamic markets.

The digital revolution in securities management has made investing more accessible and secure than ever before. With proper understanding and the right DP partnership, your NSDL demat account becomes a powerful tool for achieving your financial objectives.