What is Volume Weighted Average Price (VWAP)?

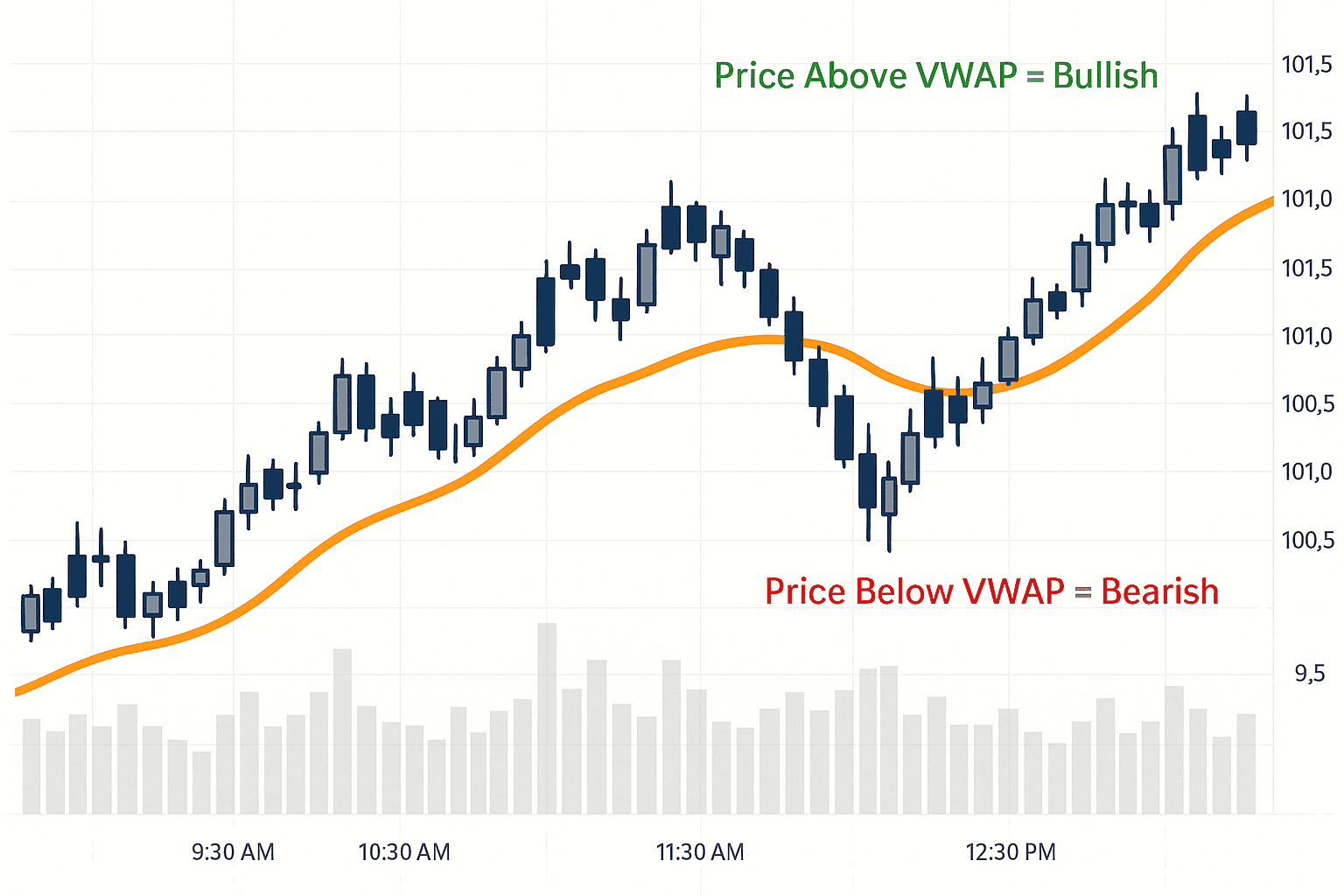

The Volume Weighted Average Price (VWAP) stands as one of the most reliable technical indicators in modern trading. This sophisticated tool provides traders with a clear picture of a security’s fair value by combining both price movements and trading volume throughout a specific period.

Unlike simple moving averages that treat all price points equally, VWAP gives more weight to prices where larger volumes were traded. This approach offers a more accurate representation of where institutional money is flowing and helps identify genuine market sentiment.

The Mathematics Behind VWAP

The VWAP calculation follows a straightforward yet powerful formula:

VWAP = Sum of (Price × Volume) ÷ Sum of Volume

This calculation runs continuously throughout the trading day, creating a dynamic line that reflects the true average price weighted by volume. When a stock trades above this line, it suggests buyers are paying premium prices. Conversely, trading below the VWAP indicates sellers are accepting discounted prices.

Anchored VWAP: A Strategic Variation

Traditional VWAP resets at the beginning of each trading session. However, anchored VWAP allows traders to set a custom starting point, such as:

- Major earnings announcements

- Significant news events

- Technical breakouts

- Market reversals

This flexibility makes anchored VWAP particularly valuable for analyzing longer-term trends and identifying key support and resistance levels.

VWAP as Dynamic Support and Resistance

One of VWAP’s most powerful applications lies in its ability to act as dynamic support and resistance. Unlike static horizontal lines, VWAP moves with the market, providing:

Support Functions:

- Price often bounces off VWAP during uptrends

- Serves as a floor for institutional accumulation

- Provides entry opportunities for long positions

Resistance Functions:

- Acts as a ceiling during downtrends

- Indicates areas where selling pressure increases

- Offers exit points for existing positions

Practical Trading Strategies Using VWAP

Entry Strategies

Trend Following Approach:

- Enter long positions when price breaks above VWAP with volume

- Initiate short positions on breaks below VWAP

- Confirm entries with additional technical indicators

Mean Reversion Strategy:

- Buy when price pulls back to VWAP in an uptrend

- Sell when price bounces off VWAP in a downtrend

- Use tight stop-losses due to quick reversals

Moving Average Crossover:

- Combine VWAP with short-term moving averages

- Look for crossovers as potential entry signals

- Validate with volume and momentum indicators

Exit Strategies

Smart exits are crucial for VWAP-based trading:

- Take profits when price extends significantly from VWAP

- Use VWAP as a trailing stop in trending markets

- Exit when price fails to hold VWAP as support or resistance

VWAP for Different Market Participants

Institutional Traders

Large institutional players leverage VWAP for:

- Executing large orders without moving the market

- Benchmarking execution quality

- Minimizing market impact costs

- Timing entries and exits for maximum efficiency

Institutions typically aim to buy below VWAP and sell above it, helping to naturally push prices back toward the average.

Day Traders

Retail day traders use VWAP differently:

- Quick scalping opportunities around VWAP

- Trend identification and confirmation

- Risk management through dynamic stops

- Intraday momentum plays

Real-World Application Example

Let’s walk through a practical VWAP calculation:

Given Data:

- High: $25.00

- Low: $20.00

- Close: $23.00

- Volume: 10,000 shares

Step 1: Calculate typical price Typical Price = (High + Low + Close) ÷ 3 = ($25 + $20 + $23) ÷ 3 = $22.67

Step 2: Multiply by volume Price × Volume = $22.67 × 10,000 = $226,700

Step 3: Track cumulative values throughout the day As the day progresses, continue adding each period’s (Price × Volume) and Volume totals.

Step 4: Calculate VWAP VWAP = Cumulative (Price × Volume) ÷ Cumulative Volume

Advanced VWAP Techniques

Multiple Timeframe Analysis

Experienced traders often monitor VWAP across different timeframes:

- Intraday VWAP for short-term trades

- Weekly VWAP for swing trading

- Monthly VWAP for position sizing

Volume Profile Integration

Combining VWAP with volume profile analysis reveals:

- High-volume nodes near VWAP

- Areas of institutional interest

- Potential reversal zones

Risk Management with VWAP

Effective risk management remains paramount when trading with VWAP:

Position Sizing:

- Reduce size when trading against VWAP

- Increase size when VWAP confirms your bias

- Never risk more than you can afford to lose

Stop Loss Placement:

- Place stops beyond VWAP with buffer for volatility

- Use percentage-based stops in highly volatile markets

- Adjust stops as VWAP moves throughout the day

Common VWAP Trading Mistakes

- Overreliance on VWAP Alone: Always combine VWAP with other technical indicators and fundamental analysis.

- Ignoring Market Context: VWAP works best in trending markets and may generate false signals during consolidation.

- Poor Timing: Entering positions too early or too late relative to VWAP signals can reduce profitability.

The Future of VWAP Trading

As algorithmic trading becomes more prevalent, VWAP strategies continue evolving. Modern traders increasingly combine VWAP with:

- Machine learning algorithms

- Alternative data sources

- Real-time sentiment analysis

- Options flow data

Conclusion

VWAP represents more than just another technical indicator—it’s a window into institutional behavior and market structure. By understanding how volume and price interact, traders can make more informed decisions about market entry, exit, and risk management.

Success with VWAP requires patience, discipline, and continuous learning. Whether you’re a day trader looking for quick profits or an institutional investor managing large positions, VWAP provides valuable insights into market dynamics that can significantly improve your trading outcomes.

Remember that no single indicator guarantees success. VWAP works best when combined with solid risk management, market knowledge, and a clear understanding of your trading objectives. Start with small positions, practice extensively, and gradually build your expertise with this powerful trading tool.