The world of trading offers numerous pathways to potential profits, each requiring different approaches, timeframes, and risk tolerances. Whether you’re drawn to lightning-fast transactions or patient, long-term positions, there’s a trading style that can align with your personality and goals.

The Trading Spectrum: From Seconds to Years

Trading styles exist on a broad spectrum of time horizons. At one end, you have traders who complete dozens of transactions within minutes, capturing tiny price movements for quick gains. At the other end, position traders hold their investments for months or even years, betting on major market trends to unfold.

The key distinction often comes down to two primary categories: intraday and positional trading. Intraday traders complete all their buying and selling within a single trading session, never holding positions overnight. Positional traders, conversely, maintain their holdings across multiple sessions, seeking to capitalize on broader market movements that develop over extended periods.

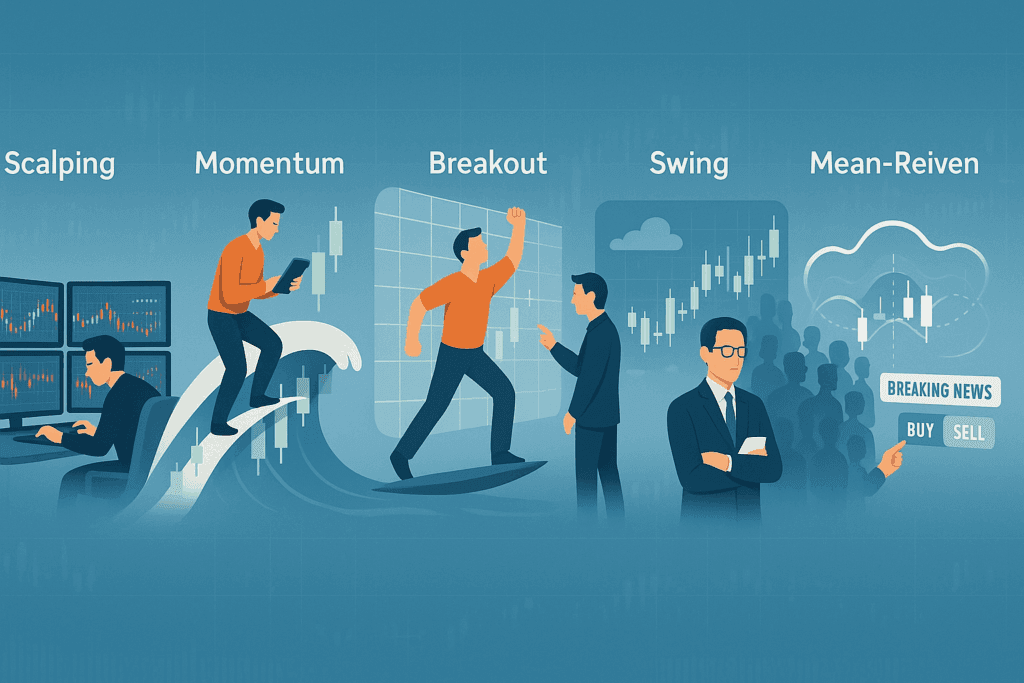

Six Distinct Trading Personalities

The Lightning-Fast Scalper

Scalpers represent the Formula 1 drivers of the trading world. They execute numerous trades throughout each session, targeting minimal price movements that occur within minutes or even seconds. This micro-trading approach requires exceptional focus, advanced technology, and nerves of steel.

Success in scalping demands split-second decision-making and deep market awareness. Since individual profits are typically small, scalpers must maintain high accuracy rates and execute large volumes of trades to generate meaningful returns.

The Momentum Traders

Momentum traders are like skilled surfers who know how to ride the biggest waves. They identify stocks experiencing strong directional movements and position themselves to profit from continued momentum in that direction.

When they spot an upward surge, momentum traders jump aboard early, riding the wave until signs suggest the trend is weakening. Conversely, during downward movements, they may short-sell, profiting as prices continue to decline.

The Breakout Traders

Breakout traders are patient stalkers who wait for the perfect moment to strike. They study price charts intently, identifying key support and resistance levels where stocks have historically struggled to move beyond.

When a stock finally breaks through these critical barriers with strong volume, breakout traders pounce, expecting the momentum to carry prices significantly further in the breakout direction. Their success depends on distinguishing genuine breakouts from false signals.

Swing Trader

Swing traders operate like skilled meteorologists, reading market patterns to predict short-term weather changes. They typically hold positions for several days to weeks, using technical analysis to identify recurring patterns and trend shifts.

This approach offers a middle ground between day trading’s intensity and long-term investing’s patience. Swing traders can often maintain regular jobs while managing their positions, as they don’t require constant market monitoring.

Mean Reversion

Mean reversion traders are the market’s contrarians, believing that extreme price movements eventually correct themselves. They buy when others are selling in panic and sell when euphoria drives prices to unsustainable levels.

These traders rely on statistical analysis and historical data, using tools like Bollinger Bands and volume-weighted average prices to identify when securities have strayed too far from their typical trading ranges.

The News Traders

News-driven traders are information junkies who thrive on market-moving events. They position themselves around earnings announcements, economic releases, geopolitical developments, and other catalysts that create significant price volatility.

Speed and preparation are crucial for news traders. They must quickly interpret new information and act before the broader market fully processes the implications.

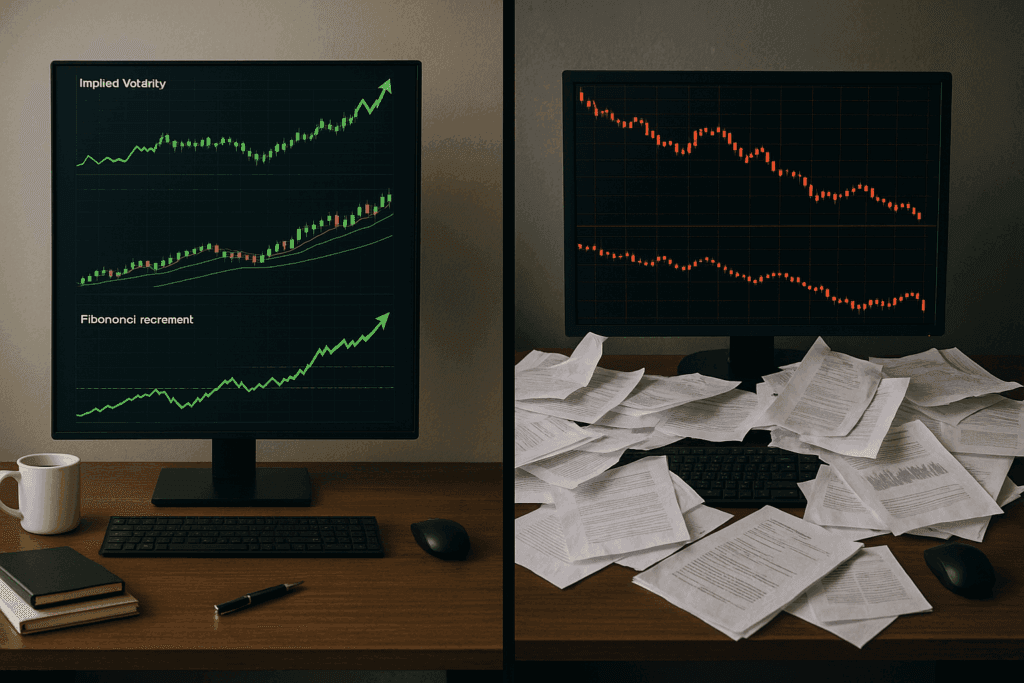

Weighing the Trade-offs

Each trading style presents unique advantages and challenges:

- Scalping offers limited overnight risk but demands intense concentration and generates high transaction costs through frequent trading.

- Momentum trading can deliver substantial profits when executed well but requires precise timing and carries the risk of sudden trend reversals.

- Breakout trading provides clear entry signals and early access to strong moves but suffers from frequent false breakouts that can trigger losses.

- Swing trading reduces the need for constant monitoring and helps avoid overtrading, though positions remain vulnerable to overnight news and market gaps.

- Mean reversion works exceptionally well in sideways markets but can produce prolonged losses when strong trends persist longer than expected.

- News trading benefits from clear catalysts and predictable short-term volatility but faces execution challenges when unexpected events create rapid price movements.

Finding Your Trading Identity

Selecting the right trading approach isn’t about finding the “best” style—it’s about finding the best fit for your unique circumstances. Consider these critical factors:

- Time Availability: Can you monitor markets continuously, or do you need a more passive approach?

- Risk Tolerance: Are you comfortable with frequent small losses, or do you prefer fewer, larger positions?

- Personality Type: Do you thrive under pressure, or do you prefer methodical, patient approaches?

- Capital Requirements: Some styles require larger account balances to be effective.

- Learning Curve: Different approaches demand varying levels of technical knowledge and experience.

The Journey Forward

Remember that choosing a trading style isn’t a permanent decision. Many successful traders begin by exploring multiple approaches, gradually discovering what resonates with their personality and circumstances. As you gain experience and refine your skills, your preferred style may evolve.

The most important step is to start with proper education, realistic expectations, and careful risk management. Whether you become a lightning-fast scalper or a patient swing trader, success ultimately depends on discipline, continuous learning, and adapting to ever-changing market conditions.

Your trading journey is unique—embrace the exploration process and allow your natural strengths to guide you toward the approach that feels most authentic to your goals and temperament.