In the dynamic world of financial markets, timing isn’t just everything—it’s the difference between profit and loss. While some traders chase minute-by-minute price movements and others hold positions for years, there’s a sweet spot that many successful traders have discovered: swing trading.

What Is Swing Trading?

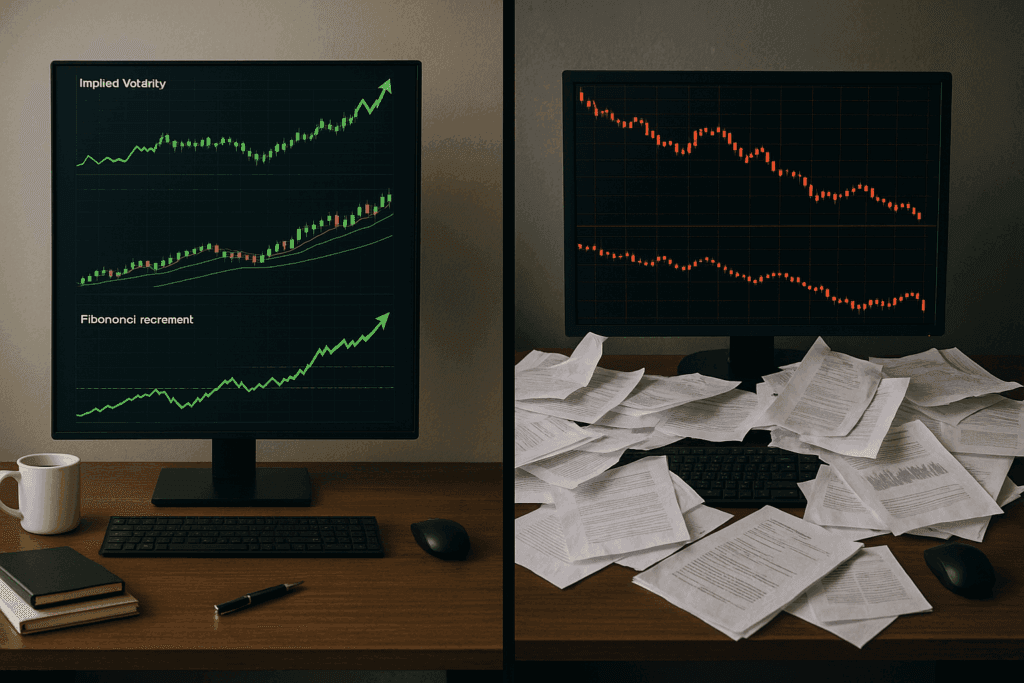

Think of swing trading as the “Goldilocks” approach to market participation—not too fast, not too slow, but just right. This strategy involves holding positions for several days to several weeks, capturing the natural rhythm of price movements as they oscillate between peaks and valleys.

Unlike the high-pressure environment of day trading, where positions must be closed before market close, swing trading allows you to breathe. You’re not glued to your screen all day, yet you’re not passively waiting months or years for returns like traditional investors.

The Psychology Behind Market Swings

Markets have personalities, and understanding this personality is crucial for swing traders. Prices rarely move in straight lines—they breathe, expanding and contracting like a living organism. This happens because markets are driven by human emotions: fear, greed, optimism, and pessimism.

When buyers get excited, prices surge upward, but eventually, some take profits, causing temporary pullbacks. When sellers dominate, prices decline, but bargain hunters step in, creating bounces. These natural fluctuations create the opportunities that swing traders capitalize on.

Essential Tools for Success

Successful swing trading relies heavily on technical analysis—reading the story that price charts tell us. Here are the core tools that professionals use:

- Moving Averages: These smooth out price action and help identify the overall direction. Many traders watch the 20-day and 50-day moving averages as key reference points.

- Momentum Indicators: Tools like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help identify when an asset might be overbought or oversold.

- Support and Resistance Levels: These are price zones where buying or selling pressure has historically been strong. Think of them as psychological battlegrounds between bulls and bears.

Proven Strategies That Work

The Trend Continuation Play

This strategy follows the old Wall Street wisdom: “The trend is your friend.” When a strong uptrend experiences a temporary pullback, swing traders look for entry points as the price bounces back in the direction of the main trend.

Support and Resistance Bounces

Experienced traders identify key price levels where stocks have repeatedly found support or hit resistance. They position themselves to profit when prices bounce off these critical zones.

Breakout Trading

Sometimes stocks trade within tight ranges before making explosive moves. Swing traders position themselves to capture these breakouts when prices finally break above resistance or below support.

Pattern Recognition

Markets often repeat historical patterns. Formations like double tops, head and shoulders, or cup-and-handle patterns can signal potential turning points, giving traders clear entry and exit strategies.

A Real-World Example

Consider a technology stock that’s been trending upward but experiences a temporary 10% pullback due to broader market concerns. A swing trader might:

- Identify that the pullback has reached a key support level

- Confirm that volume is decreasing on the decline (suggesting selling pressure is waning)

- Enter a position when the stock shows signs of bouncing

- Set a stop-loss below the support level to limit risk

- Target a move back toward recent highs for profit-taking

This approach allows the trader to risk $2 per share while potentially gaining $6-8 per share—a favorable risk-reward ratio that makes long-term profitability possible even with moderate win rates.

The Advantages of Swing Trading

- Flexibility: Unlike day trading, you don’t need to monitor positions constantly. You can maintain a regular job while swing trading.

- Better Risk Management: Longer holding periods allow for more thoughtful decision-making and less emotional trading.

- Capture Meaningful Moves: While day traders might profit from small price fluctuations, swing traders aim for more substantial price movements.

- Lower Transaction Costs: Fewer trades mean lower commission costs and reduced market impact.

Understanding the Risks

Every trading strategy has its challenges, and swing trading is no exception:

- Overnight Risk: Holding positions overnight exposes you to news events and gap openings that can work against you.

- Patience Required: Successful swing trading demands discipline and the ability to wait for the right setups.

- False Signals: Not every technical pattern or signal works out as expected. Risk management is crucial.

- Emotional Challenges: It can be difficult to hold positions through temporary adverse moves while waiting for your thesis to play out.

Risk Management: Your Safety Net

Professional swing traders never risk more than they can afford to lose on any single trade. Many follow the 2% rule—never risking more than 2% of their trading capital on one position. They also use stop-loss orders to automatically exit losing trades before losses become substantial.

Position sizing is equally important. Rather than putting all their capital into one “sure thing,” successful traders diversify across multiple positions and sectors.

Getting Started: A Practical Approach

If you’re considering swing trading, start with education and paper trading. Practice identifying setups and managing positions without real money at risk. Focus on a few markets or sectors initially rather than trying to trade everything.

Develop a trading plan that includes:

- Entry criteria

- Exit strategies (both profit targets and stop-losses)

- Position sizing rules

- Maximum number of simultaneous positions

The Bottom Line

Swing trading offers an attractive middle ground for those who want more activity than buy-and-hold investing but less stress than day trading. Success requires a combination of technical skill, emotional discipline, and sound risk management.

Remember, no trading strategy guarantees profits, and past performance doesn’t predict future results. However, for those willing to put in the effort to learn and practice, swing trading can be a rewarding way to participate in financial markets while maintaining a balanced lifestyle.

The key is to start small, learn continuously, and never risk more than you can afford to lose. With patience and discipline, swing trading can become a valuable skill in your financial toolkit.